Global warming and the makings of a market crisis

Welcome to Callaway Climate Insights. Especially to our new subscribers this month, the hottest July in recorded history. Please enjoy, and share.

Today’s edition is free. To read our insights and support our great climate finance journalism four days a week, subscribe now for full access.

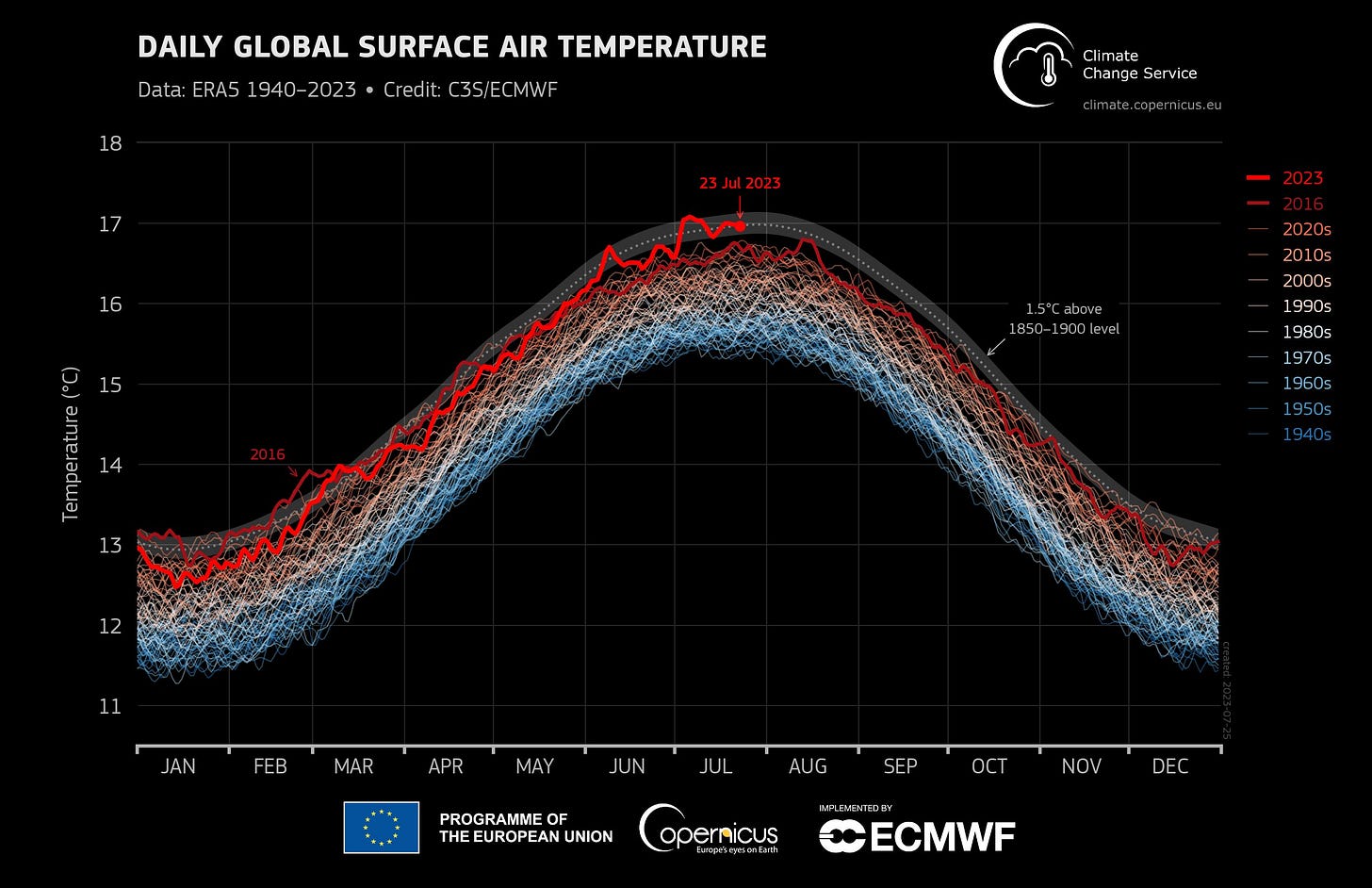

This chart shows the daily global surface air temperatures from 1940 to 2023. The World Meteorological Organization, citing data from Copernicus Climate Change Service, says the first 3 weeks of July have already broken several significant records, including hottest day globally and hottest three weeks globally. These temperatures have been related to heat waves in large parts of North America, Asia and Europe, which along with wildfires in countries including Canada and Greece, have had major impacts on people’s health, the environment and economies.

LONDON (Callaway Climate Insights) — This summer’s climate disasters in Europe, the U.S. and Canada have focused financial minds on the prospects that rapidly changing weather patterns could lead to a market crisis, a la the subprime mortgage crisis of 2007.

Both the International Monetary Fund and the respected Chatham House think tank in London came out with warnings this week about the potential for material risks developing, such as food inflation, a real estate crisis or hot-weather pandemics.

Granted, it’s hard to ignore the extreme heat, fires and floods that have plagued the Northern Hemisphere this summer. Organizations such as the IMF are responsible for pointing at risks and climate change is certainly one. And goodness knows, it may take a financial shock to the system such as the financial crisis a decade ago to finally get political and business attention.

But to us, the rapidly deteriorating conditions seem more like a slow-motion car wreck than a harbinger of a shock crisis such as subprime. While that mortgage crisis developed behind the scenes in banking loan books, the climate crisis is on our front pages and video screens. Events like the withdrawal of new homeowner insurance coverage in places such as California and Florida, and the oil industry’s takeover of the global climate conversation following the Russian invasion of Ukraine, are the inevitable result of us not listening to the drumbeat of warnings over the years. Not a surprise crisis, which is how almost all of them begin.

Climate change is already changing financial markets with new risks and importantly, new opportunities. Like global warming itself this summer, it isn’t some future crisis investors should be focusing on, it’s market conditions right now.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Zeus: European election turmoil threatens climate agenda

. . . . A year after Russia’s Vladimir Putin invaded Ukraine, sending energy prices soaring across Europe, a backlash against costs tied to any shift to renewable energy is hitting the electorate, writes David Callaway from London. Right-wing candidates are making inroads in many countries, in part by using popular campaigns against anything green. The movement has reached Brussels itself, which until now had been seen as a global leader in the transition and surprisingly comes against the backdrop of the hottest summer in history, with fires raging across Greece and Italy. . . .

Thursday’s subscriber insights

Do you have range anxiety? These kind people want to help

. . . . The lack of a robust charging network in the U.S. has long been seen as a barrier to wide adoption of electric vehicles. Now, seven big automakers have joined forces to step up the number dramatically. It can only be a good thing. Read more here. . . .

. . . . Think that politics is a sideshow when it comes to climate change and trying to fight it? Witness former President Donald Trump’s pledge, if he is re-elected, to “rein in” the Federal Energy Regulatory Commission, a five-member independent agency with significant influence over climate and energy policies in the U.S. Read more. . . .

Editor’s picks: We need three times as much renewable capacity, says IEA

Three times the current global renewable capacity is needed

Governments around the world should commit to tripling global renewable capacity by 2030 ahead of the UN’s COP28 climate change conference set for late November in Dubai, says the International Energy Agency. In a recent commentary, the IEA says “the single most important lever to bring about the reduction in CO₂ emissions needed by 2030 is to triple the global installed capacity of renewable power by the end of the current decade.” The IEA says its roadmap to next zero makes clear that, massively scaling up a wide range of clean energy technologies this decade, plus doubling progress on energy efficiency is necessary to drive down demand for fossil fuels and reach net zero quickly enough. Solar PV in particular is providing grounds for optimism on the pace of renewable expansion, says the IEA. It’s on course to account for two-thirds of this year’s increase in global renewable power capacity and further strong growth is expected in 2024, the agency reports.

Vital ocean current system could collapse sooner than expected

Scientists are warning of the future collapse of a huge system of ocean currents — and a major tipping element in the climate system. The Atlantic Meridional Overturning Current — of which the Gulf Stream is a part — could collapse around the middle of the century, or even as early as 2025, according to research published this week in the journal Nature Communications. The article authors say a weakening in circulation has been reported in recent years, and they estimate a collapse of the AMOC to occur around mid-century under the current scenario of future emissions. If carbon emissions are not reduced, the system could collapse sooner. The AMOC plays an important role in the global climate system, and scientists have been warning for years of its instability.

Explain that: net zero

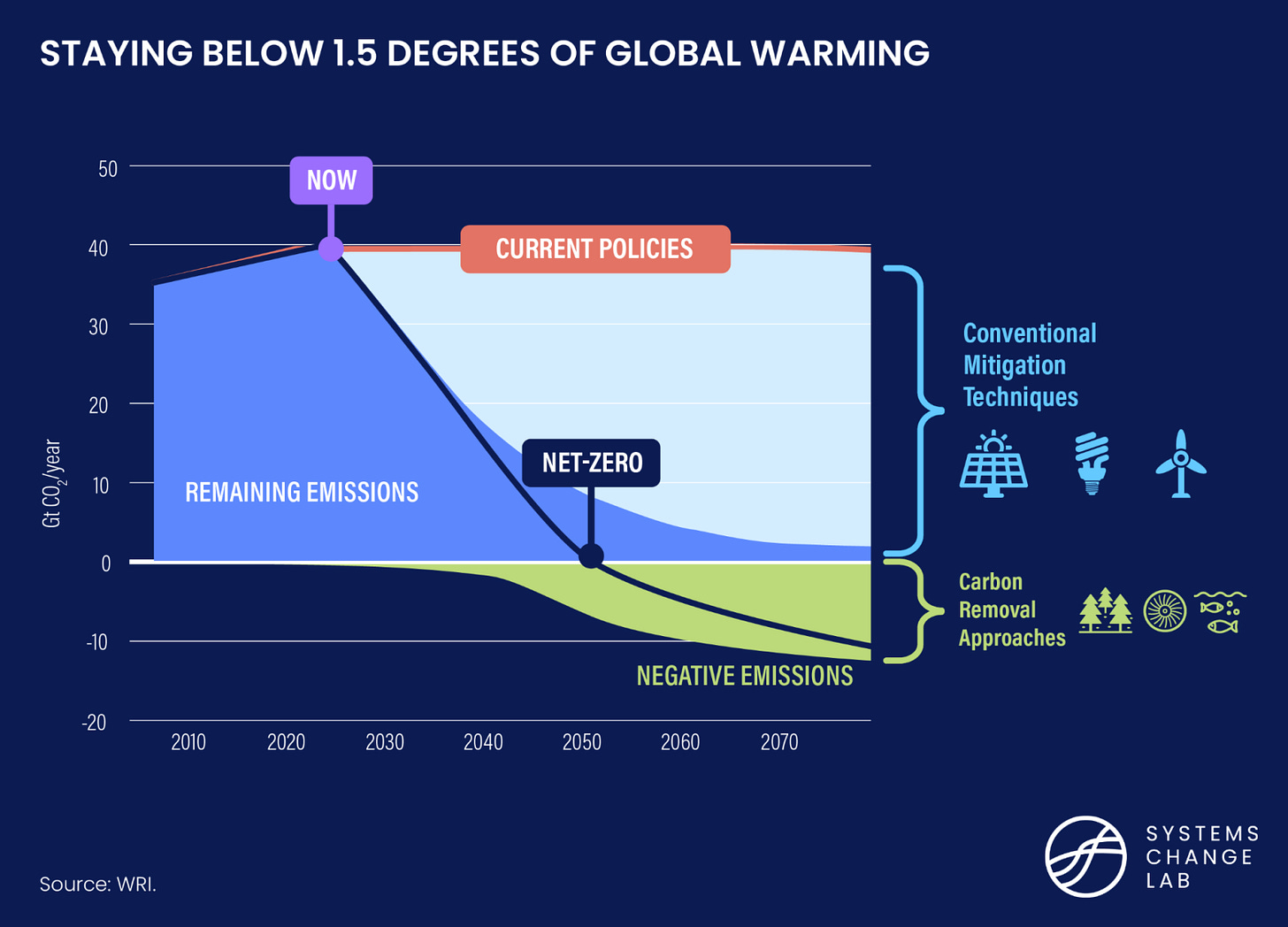

. . . . Net-zero emissions, or net zero, will be achieved when all emissions released by human activities are counterbalanced by removing carbon from the atmosphere in a process known as carbon removal. The World Resources Institute says achieving net zero will require a two-part approach: “First and foremost, human-caused emissions (such as those from fossil-fueled vehicles and factories) should be reduced as close to zero as possible. Any remaining emissions should then be balanced with an equivalent amount of carbon removal, which can happen through natural approaches like restoring forests or through technologies like direct air capture and storage (DACS), which scrubs carbon directly from the atmosphere.” According to the WRI, to achieve net-zero emissions, rapid transformation will be required across all global systems — from how we power our economies, to how we transport people and goods and feed a growing population. . . .

Words to live by . . . .

“By the time we see that climate change is really bad, your ability to fix it is extremely limited... The carbon gets up there, but the heating effect is delayed. And then the effect of that heat on the species and ecosystem is delayed. That means that even when you turn virtuous, things are actually going to get worse for quite a while.” — Bill Gates.