Green Lights Aug. 2: Top stories this week

Don't miss a single story from the best of Callaway Climate Insights.

. . . . Welcome back to Green Lights. Here’s our weekly roundup of the best of Callaway Climate Insights. This week, David Callaway looks at Warren Buffett’s sale of shares of a Chinese EV maker, assesses the election standoff in Venezuela, and surveys a meltdown for global insurers. Michael Molinski weighs in on Mexico’s new pro-climate president. Things are heating up in Paris, too. We’re heading out for our summer break and we’ll be back in your inbox Aug. 19. Try to stay cool, and please subscribe.

. . . . In Paris Thursday, Olympic athletes endured a third day close to 100°F and a run on AC units in the athlete’s village after complaints the vaunted self-cooling apartments failed to satisfy. In Rome, authorities are blaming several days of heat above 95°F for conditions leading to a wildfire. Global insurers had more than $120 billion in insured losses in the first half of this year, more than half of which was in the U.S., according to Munich Re. And the forecast for the second half of the year isn’t any cooler.

. . . . Mexico’s President-elect Claudia Sheinbaum is the latest in a line of women scientists — including Margaret Thatcher and Angela Merkel — who rose to lead their countries and sounded the alarms about climate change, writes Michael Molinski. But the world is a different place now, and when Sheinbaum takes over in October how she manages her climate pledge of $13 billion in renewable investments with the country’s rich oil heritage is a topic front and center for the global climate community.

. . . . The evolving election standoff in Venezuela is rapidly becoming a regional crisis and a major assault on democracy, but for climate watchers it also raises three major threats to South America’s environmental ambitions, writes David Callaway. How this plays out is hugely important for democracy, for investors in South America, and perhaps last but never least, the region’s precarious climate situation.

. . . . Warren Buffett isn’t known for market timing. If he gets hold of a winning investment, he rides it out. So when Buffett and his Berkshire Hathaway (BRK.B) began slashing their massive stake in Chinese electric vehicle maker BYD last year, it raised a few eyebrows. Could it be that Buffett’s sale of BYD shares is more about China than it is about electric vehicles?

. . . . U.S. home insurers lost $15.2 billion last year, more than double what they lost in 2022 and the sixth year of losses in the past seven. We’ve long argued that the first financial effects on the public would be felt through the insurance markets. The next step will be state finances and municipal markets. Climate risk is investment risk. These numbers portend some eye-popping numbers to come.

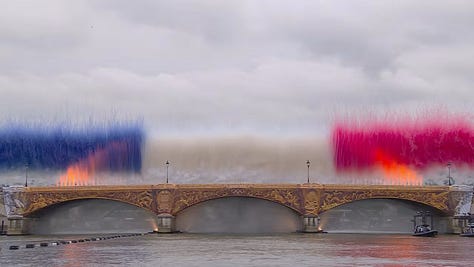

. . . . It was never going to be easy to stage a summer Olympic games in the heart of Europe during August. Along with high temps and uncertain efforts to get the Seine clean enough to swim in, more climate obstacles are inevitable. Parts of Europe are becoming too hot, and while this is the second time Paris has hosted a summer games (after 1924), it’s unlikely it will be able to host again in another 100 years.

More greenery . . . .

Heat dome: Heat wave blanketing Olympics ‘impossible’ without climate change (Politico)

Shifting sands: Hawaii's beaches are disappearing (USA Today)

Shelling out: Why coffee is becoming a costly luxury (CNN)

Skyrocketing insurance premiums: U.S. housing markets most at risk from climate change (Business Insider)

Fast track to hell?: The transit beat is becoming the climate beat (NiemanLab)