Green Lights Jan. 9: Top stories

Don't miss a single story from the best of Callaway Climate Insights.

. . . . Welcome back to Green Lights. Here’s our roundup of the best of Callaway Climate Insights. This week, David Callaway looks at what’s happening in Venezuela and what that means for the rest of the world — especially Greenland. Mark Hulbert explains why oil stocks did better when Biden was president. Plus, some perspective on the U.S.’s withdrawal from the UN Climate Framework. Have a great weekend and please subscribe to support our climate finance reporting.

. . . . Pulling the U.S. out of the United Nations Climate Framework might not be the worst thing the Trump administration did this week (See Minneapolis), but in terms of long-term damage to America’s global standing and our ability to influence trillions of dollars in new investments, it’s right up there, says David Callaway. Instead, betting the future of the U.S. on oil and gas at a time when our largest rival, China, and others are moving aggressively into cheaper green energy will go down as one of the most damaging miscalculations in geopolitical history.

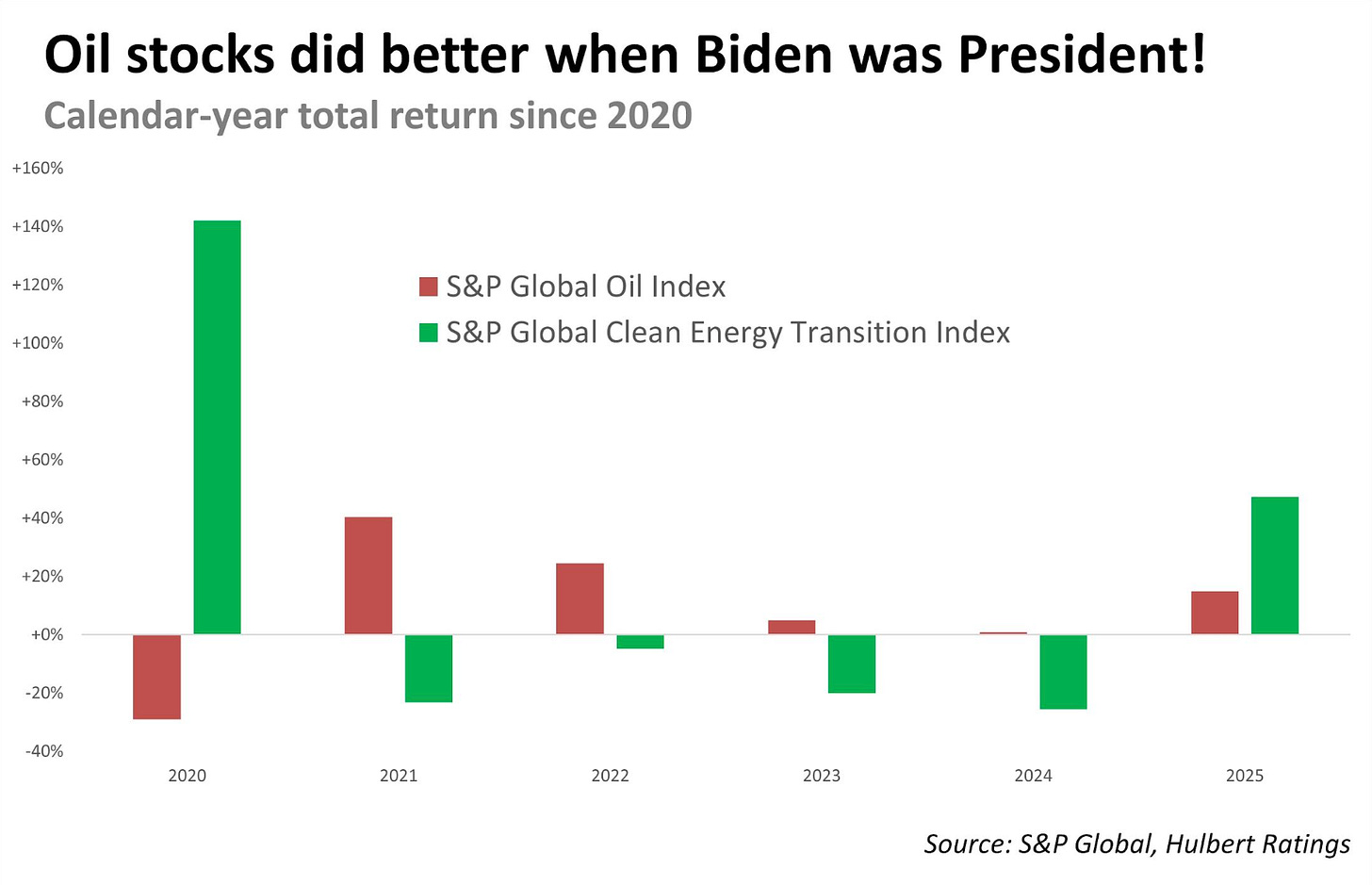

. . . . Renewable energy stocks trounced oil and gas stocks in 2025, despite a year of punishing cutbacks and closures of green projects by the Trump Administration, writes Mark Hulbert. Green stocks also beat oil during Trump’s first term, suggesting that the pace of demand for clean, cheaper energy outweighs any political rhetoric in investors’ minds. In fact, oil and gas stocks did better under Joe Biden. Perhaps 50 million more barrels of oil from Venezuela will change that dynamic, but that’s unlikely as long as big tech data centers are hungry for cheap energy.

. . . . The world awoke this first Monday of 2026 to a dangerous new threat — the potential for destabilizing political power grabs of resources across international borders. President Donald Trump’s attack on Venezuela and seizure of its dictator in the name of oil over the weekend has set every country in the region on alert. Not to mention Greenland.

. . . . After much struggling and political warfare, the EU’s Carbon Border Adjustment Mechanism finally went into effect last week, becoming the largest carbon border tax in history and shaking up trade in global iron, steel, and even electricity, among other commodities. With all forms of efforts to limit or reduce harmful greenhouse gases under attack in the U.S. and abroad these days, we expect the CBAM will face increased hostility in coming months, as well as some form of retaliation.

. . . . We’ve all known it was coming for some time but last week’s headlines revealing Chinese EV maker BYD finally passed Tesla TSLA 2.31%↑ in deliveries was stunning not for the fact that BYD did it but by how much. Elon Musk has now taken the attitude that it’s all about robotaxis and driverless cars, and that’s been good enough for shareholders to date. But Tesla still needs to sell a ton of product to fund all of its research into autonomous driving and the roll out of any new fleets.

. . . . Last year ranks as the third-highest year (after 2023 and 2024) for billion-dollar weather and climate disasters — with 23 such events costing a total of $115 billion in damages, according to Climate Central. The January 2025 Los Angeles wildfires were the costliest event of the year as well as the costliest wildfire on record. With $61.2 billion in damages, this devastating event was about twice as costly as the previous record wildfire, Climate Central said in its annual review.

More greenery . . . .

Sun block: Companies are coming up with plans to block out the sun (The Independent)

Chasing methane: Hunting a climate-changing gas seeping from the seafloor (Mongabay)

Mis- and disinformation: Scientists push back on climate myths (Yale Climate Connections)

Higher bridges: AI improves flood projections under climate change (Phys.org)

In hot water: Persistent river heatwaves are emerging worldwide (Nature)