Ocean investing so far more promise than profit

Welcome to Callaway Climate Insights. And happy National Ocean Day. Please take a moment to share this with an interested colleague.

In the frothy world of ESG stocks, ocean investing is still just a proverbial drop in the $2 trillion bucket.

The same confusing metrics and lack of definition that plagues the environmental, social and governance sector is even murkier in the so-called Blue Economy, where ocean investments can range from fisheries and shipping companies to plastic removal or even Caribbean hotel resort chains. If it happens in or near an ocean, it counts.

On this National Ocean Day, it’s important to point out that investing in cleaning up the ocean is a vital component of mitigating the effects of climate change. It’s also sexy, and more conferences and coverage are being devoted to it by the day.

My friend and former colleague Peter Moreira, who runs the successful Entrevestor Canadian startup newsletter in Halifax, told me just yesterday he’s starting a new business channel just on ocean technology, which by its very definition is global. You can check it out here.

Others have started early funds or ETFs. The Global ESG Blue Economy ETF, started by France’s Paribas last year, has attracted 96 million euros ($117 million) so far and is up 14% year-to-date, reaching a new high this week amid the ocean month celebrations.

Even the U.S. Congress is jumping over, uh, on board. A House committee in October filed the Ocean-based Climate Solutions Act, which would restrict deep-sea drilling and invest in seaborne de-carbonization strategies. And software giant Salesforce (CRM) just this morning announced an ocean restoration priority and the appointment of a director of ocean sustainability, Dr. Whitney Johnston.

Like the plastic in the Great Pacific Garbage Patch, there is a lot of money starting to swirl around in blue investing, particularly in the blue bonds arena. The number of $2.5 trillion is loosely tied to economic value of the world’s oceans, and we can expect to see more investment firms hiving off ocean products from their ESG platforms.

But until more rigor is applied to its metrics and definitions, as well as its overall goals, ocean investing, like it’s broader ESG family, is still more promise than profit.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Tuesday’s subscriber insights: Worker shortage imperils Biden’s green agenda, plus the four-million-year carbon storm

Sign up for a free trial of Callaway Climate Insights to see all of our best offerings each week, and archives of our best interviews.

. . . . This week introduced the concept of the “earthshot,” which is like a moonshot but tied to environmental projects. Trouble is, the worker shortage plaguing America as it reopens threatens almost all of these ambitious projects. A reckoning is at hand. Read more here. . . .

. . . . Money being made on ESG funds, electric vehicles and wind production is encouraging, but a new report this week that carbon levels hit a four-million-year high last month sobers the outlook. What’s behind the disturbing prospects here and is there a way to invest our way out? Read more here. . . .

Editor’s picks: Kelp for climate change, cleaner cleaning products, and drought elevates environmental, fire risks

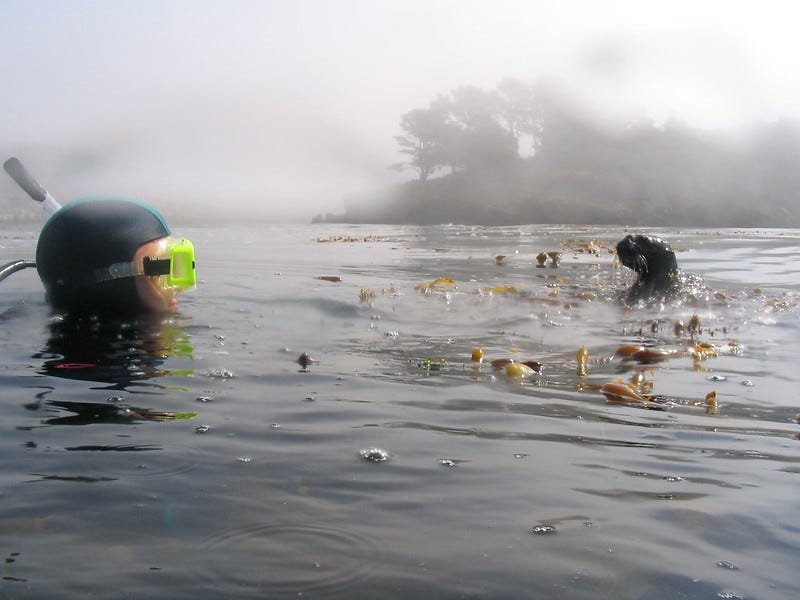

Startups using kelp to fight climate change

Kelp, a type of seaweed, is important for its nutritional value and its ability to absorb and store CO₂ more effectively than trees. It also can absorb harmful compounds from seawater. GreenBiz writes about four startup companies “working to preserve the world’s marine ecosystems, while playing a key role in combating food insecurity and climate change.” Kelp Blue runs giant underwater farms where it grows seaweed crops that are harvested for agri-foods, fertilizers, pharmaceuticals and cosmetics. Sea6 Energy is all about scaling up and mechanizing tropical seaweed farming. GreenBiz also includes the Australian Seaweed Institute and Cascadia Seaweed on the list.

Cleaning product companies are cleaning up

The American Cleaning Institute is challenging companies in the cleaning products industry and supporting supply chains to align their corporate climate strategy and targets with the Paris Accord, Environment+Energy Leader reports. Fifteen ACI members have already stepped up to the challenge with science-based commitments. According to the report, BASF (BASFY) recently announced it wants to achieve net-zero emissions by 2050. To accomplish that, the company wants to reduce its greenhouse gas emissions worldwide 25% by 2030. Colgate-Palmolive (CL) has committed to net zero carbon by 2040 and 100% renewable electricity in its global operations by 2030. Colgate’s climate goals on Scope 1, 2 and 3 were approved in 2020 by the Science-Based Targets initiative, and are aligned with the Business Ambition for 1.5°C.

Lower reservoir levels, higher water-supply and fire risks

Over Memorial Day weekend, dozens of houseboats sat on cinder blocks at California’s Lake Oroville because there wasn’t enough water to hold them, Adam Beam writes for the Associated Press. Beam notes the significance of the low-water levels, “Lake Oroville helps water a quarter of the nation’s crops, sustain endangered salmon beneath its massive earthen dam and anchor the tourism economy of a Northern California county that must rebuild seemingly every year after unrelenting wildfires. … If Lake Oroville falls below 640 feet — which it could do by late August — state officials would shut down a major power plant for just the second time ever because of low water levels, straining the electrical grid during the peak demand of the hottest part of the summer.” The drought risk is only growing across the west, with fire season looming.

Sign up with a 30-day free trial for all our news and insights.

Data driven: A species in the spotlight

. . . . The Hawaiian monk seal is one of the most endangered seal species in the world. The National Oceanic and Atmospheric Administration says the population overall had been declining for six decades, and current numbers, though increasing, are only about one-third of historic population levels. Importantly, however, the current upward trend is in part due to NOAA Fisheries recovery efforts. Hawaiian monk seals are found in the Hawaiian archipelago which includes both the main and Northwestern Hawaiian Islands and rarely at Johnston Atoll which lies nearly 1,000 miles southwest of Hawaii. These monk seals are endemic to these islands, occurring nowhere else in the world. Hawaiian monk seals are protected under the recovery efforts. The Hawaiian monk seal is one of NOAA Fisheries’ Species in the Spotlight. This initiative is a concerted, agency-wide effort launched in 2015 to spotlight and save the most highly at-risk marine species. . . .