Scorched earth investing, a new ocean fund, and the $1.75 million elephant

Welcome to Callaway Climate Insights, which this weeks features Arthur Mitchell, former general counsel for the Asian Development Bank.

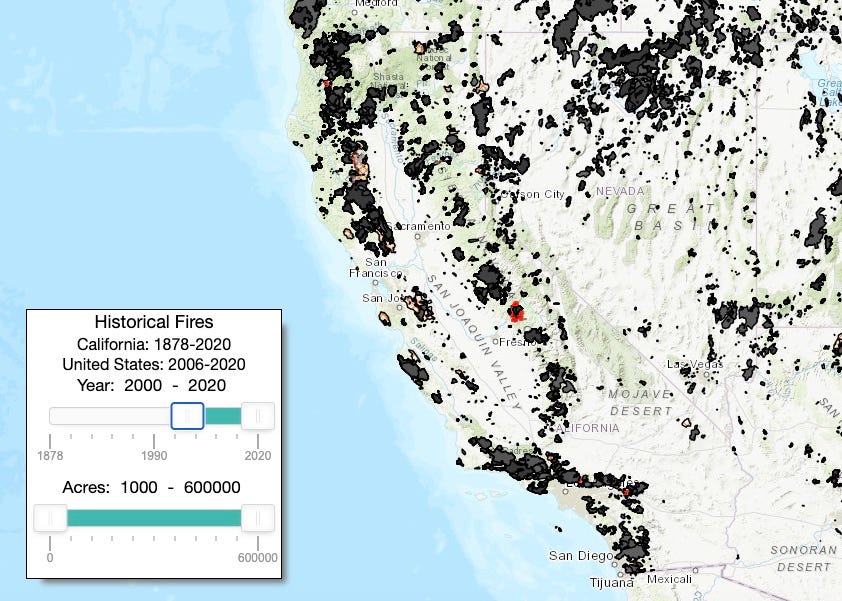

Above, this WIFIRE Firemap image shows the burn area of fires in California from 2000 through the active perimeters of fires burning as of Sept. 7, 2020 (in red).

. . . . A smoky, orange haze kicks off the beginning of autumn this morning in the Bay Area as red flag fire and evacuation warnings, forced power outages, earthquakes and high winds cast an end-of-times pall over much of California. More than two million acres have burned already this season and we haven’t even hit the October peak yet.

You can’t blame it all on air conditioners, but the surge in energy usage as the recent heat wave (116°F. in Napa County) hit is certainly one of the reasons for the blackouts, and one of the most interesting investing opportunities for those looking on how to play the climate emergency.

This fascinating piece in the MIT Technology Review cites a prediction by the International Energy Agency that AC units worldwide will triple to more than six billion in the next 30 years. Less, if buying in my neighborhood is any indication.

But it notes that little has been done to address the energy waste created by the cooling systems in terms of new technology. A few startups, such as Transaera, out of MIT, and SkyCool Systems in Mountain View, Calif., are mentioned for their interesting technologies. But in many ways the problem lies with revamping our grids to more cleanly produce the huge surge in electricity that is to come worldwide.

More insights below, including a look at a new fund for the “blue economy.”. . . .

And don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Oceantech and sustainable investment in Europe

Above, humpback whales off Maui. Photo: NOAA.

. . . . Thar she blows: Credit Suisse (CS) later this month will launch a new fund dedicated to ocean preservation with Rockefeller Asset Management, part of a growing trend of specific funds within the climate change space tied to the so-called blue economy. The Credit Suisse Rockefeller Ocean Engagement Fund will be offered to institutional and retail investors in Europe and focus on companies trying to fight the pollution of the ocean and/or create products from its resources with social impact.

The new fund is part of a growing trend of global asset managers and venture capitalists to create subthemes in the climate change universe as more investors aim their goals in that direction. Oceantech is one of the sexier subthemes as it is broad enough to apply to almost any company that is working with the sea, from sustainable fishing to offshore wind farms.

. . . . Supply side: Apple (AAPL) announced a wind turbine investment in Denmark last week that it said will power its data center in Viborg with renewable energy, as it seeks to convert its entire supply chain to renewable by 2030. The two turbines, 200 meters tall each, will power the 45,000 square meter facility, which provides service and data storage to products such as the Apple Store, iMessage, and Siri.

The announcement was the second renewable deal in Europe last week, following an agreement by German supplier Varta to run its Apple production on 100% renewable energy. Apple’s Lisa Jackson, vp of environmental, policy and social initiatives, is spearheading the company’s initiative to convert all of its supply chain to net-zero in the next decade. To date, 72 manufacturers in 17 countries have committed to going to full renewable energy for their Apple contracts. No word yet on how many, particularly in Asia, remain to sign up. . . .

. . . . SPAC stack: Another in the growing list of electric vehicle companies taken public through special purpose acquisition companies was announced this week: 10-year-old Bay Area company QuantumScape, the solid-state battery company backed by Volkswagen Group (VLKAF). QuantumScape raised $700 million, which it said will be used toward first production of its batteries, and trade under the ticker QS. The battery play is one of the most promising ways new technologies can help revamp old industries to be more climate friendly and create new sources of energy. California has been a leader in the group, and QuantumScape, which came out of Stanford University, is one of older players in the market.

Sustainability Stars: Arthur Mitchell

. . . . As general counsel for the Asian Development Bank, Arthur Mitchell learned about the developmental challenges of several Asia countries, as well as how to juggle multiple stakeholders, writes Marsha Vande Berg, a pension and international economics expert with a focus on Asia. In particular, Mitchell said he learned about the importance of good corporate governance, which led to his focus on ESG in recent years. He said the pandemic has increased the need for environmental, social and governance impact more than ever as it has illustrated how low income bracket and emerging markets suffer more in times of global distress.

Refreshingly, he pegs growth in ESG to compensation, which is one of the few ways to get people to sit up and take notice.

It is important for all corporate directors to keep a critical eye on current and emerging risks, such as climate change. ESG will become one of the pillars upon which the effectiveness of corporate managers is based and will play a part in compensation packages. . . .

Data driven: Direct air capture technology

. . . . In its 2020 tracking report, the International Energy Agency says there are currently 15 direct air capture plants operating worldwide, capturing more than 9,000 tCO₂/year, with a 1 MtCO₂/year capture plant in advanced development in the United States. In the SDS, direct air capture is scaled up to capture almost 10 MtCO₂/year by 2030. This goal is within reach, the IEA says, but will require several more large-scale demonstrations to refine the technology and reduce capture costs. . . .

Photo: Harrion Raymond/flickr.

News briefs: Clean Air Day, no case for coal investment

Editor’s picks:

UN’s Guterres: No rational case for coal investment

EPA relaxes rules limiting toxic waste from coal plants

‘Water wars’ seen escalating due to climate change

Latest findings: New research, studies and papers

An elephant is worth $1.75 million

In the paper titled On Valuing Nature-Based Solutions to Climate Change: A Framework with Application to Elephants and Whales, the authors develop a framework for natural resource valuation that directly addresses the fundamental collective action problem in environmental protection. The framework uses the lessons of behavioral economics to create values that individual decision makers find credible and relatable, in addition to stimulating excitement or concern that is essential to prompting action. They then apply this framework to value forest elephants in Africa and great whales that are found off the coasts of Brazil and Chile. The values they estimate for individual members of these species are significant: $1.75 million per forest elephant and an average of $2 million per whale. They discuss how our valuations lead to new designs for environmental preservation and restoration policies.

Authors: Ralph Chami, International Monetary Fund; Connel Fullenkamp, Duke University Department of Economics; Fabio Berzaghi; Università degli studi della Tuscia; Sonia Español-Jiménez; Milton Marcondes, Baleia Jubarte; and Jose Palazzo, Baleia Jubarte.

Economic Research Initiatives at Duke working paper series, available at SSRN.

Fossil natural gas exit: European energy transformation

From the abstract: This paper discusses the potential role of fossil natural gas (and other gases) in the process of the energy transformation in Europe on its way to complete decarbonization. … The paper proposes to replace the dominant narrative (“natural gas in decarbonizing European energy markets“) with what we consider a more coherent narrative in the context of decarbonization: Fossil natural gas exit.

Authors: Christian von Hirschhausen, German Institute for Economic Research (DIW Berlin) - Department of International Economics; Claudia Kemfert, DIW Deutsches Institut für Wirtschaftsforschung; Fabian Praeger.

DIW Berlin, German Institute for Economic Research discussion paper series, available at SSRN.

Uncertainty spillovers for markets and policy

From the abstract: In this essay, the author shows that featuring this uncertainty more in economic analyses adds to our understanding of how financial markets work and how best to design prudent economic policy. This essay explores methods that allow for a broader conceptualization of uncertainty than is typical in economic investigations. … The author illustrates these methods in two example economies in which the understanding of long-term growth is limited. One example looks at uncertainty ramifications for fluctuations in financial markets, and the other considers the prudent design of policy when the quantitative magnitude of climate change and its impact on economic opportunities is unknown.

Author: Lars Peter Hansen, University of Chicago Department of Economics; National Bureau of Economic Research

University of Chicago, Becker Friedman Institute for Economics Working Paper No. 2020-121; available at SSRN.