Supreme Court sets dangerous new precedent in attack on climate

Welcome to Callaway Climate Insights. Not a subscriber? See our 4th of July holiday offer below.

For the next week, Callaway Climate Insights is announcing a 25% cut in subscription prices for all new subscribers to $149 a year, or $15 a month. Next week, we will move to a schedule of publishing for subscribers only for three of the four days each week, while publishing for everybody on Thursdays. SUBSCRIBE NOW and support our great climate finance journalism.

The U.S. Supreme Court made history today, but not for bringing on the first black woman justice — with all due respect to the historic moment of Justice Ketanji Brown Jackson’s swearing in.

The court set a dangerous new precedent in its shift to political activism, which dates back 22 years to Bush v. Gore, by pre-emptively going after the executive branch’s attempts to set business rules through regulatory agencies, in this case the Environmental Protection Agency and its fight against climate change

In its 6-3 ruling in West Virginia v. EPA, the court ruled the agency doesn’t have the authority to make national decisions around greenhouse gas emissions from power plants, and that only Congress can make decisions that large. While the Clean Air Act of 1970 does give the EPA authority to regulate the environment, emissions were not mentioned in the law 52 years ago when it passed.

Since there is no current update to the law that mentions emissions for the court to rule on, which is what it is supposed to do, it simply used this case to pre-empt the regulator from establishing any new rules that might create blanket restrictions intended to reduce emissions. Essentially violating the concept of judicial restraint. This will have far-reaching repercussions, including any national attempt to regulate auto emissions or set minimums for clean energy usage, or require corporate climate disclosures for that matter.

We have all the details of the ruling and what it means for the future of the administrative state in Bill Sternberg’s excellent analysis below. But in short, the court has — in one week — withdrawn constitutional rights from half the population and written a blank check for business to operate without fear of regulation.

In such a broken Democratic system, where the judicial branch has moved to activist from arbiter, the need for the private sector to develop clean technologies to fight global warming in the government’s absence could not be more important.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

7 takeaways from the Supreme Court’s greenhouse gas ruling

. . . . The high court’s ruling in West Virginia v. EPA will have far-reaching implications, even beyond climate change, writes Bill Sternberg from Washington D.C. Starting with the fact that most businesses didn’t even want the court to take away the EPA’s power, Sternberg details how the ruling will affect Congress, the Biden administration, and a raft of other regulations designed to protect the environment and everything else. In one leap, the high court has put under threat the entire concept of the administrative state. . . .

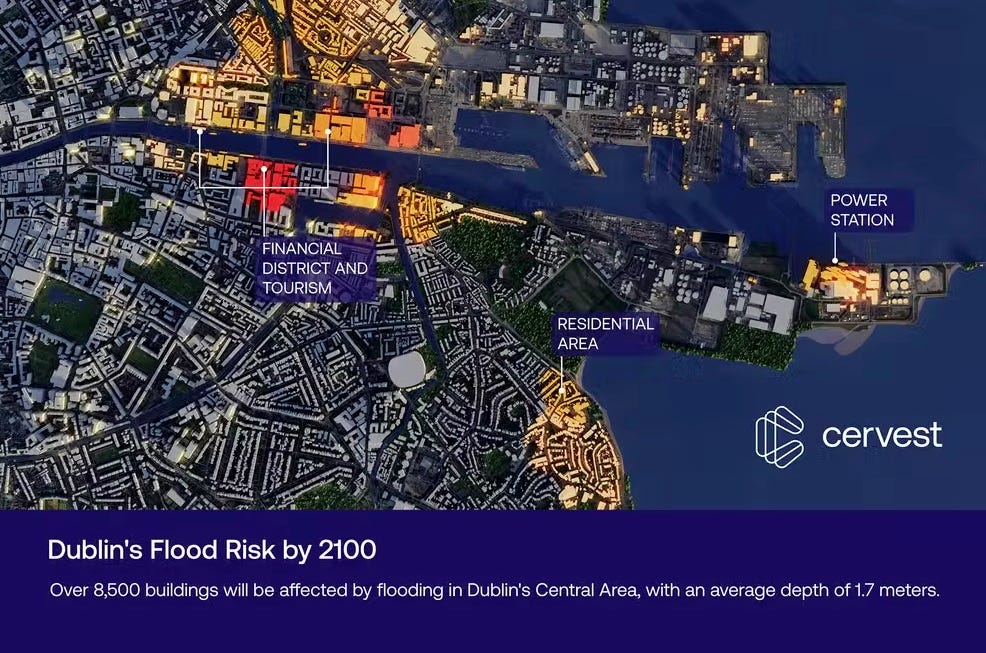

Zeus: The other side of the SEC disclosure letters

. . . . With Wall Street pounding the SEC to dilute its proposed climate disclosure rules to save companies money and reduce confusion, David Callaway looks at a handful of the thousands of letters that came in to support more transparency around climate risk, and what specific types of disclosure they recommend. With risks to buildings, towns and cities increasing every year, the time for more information is now, not later. . . .

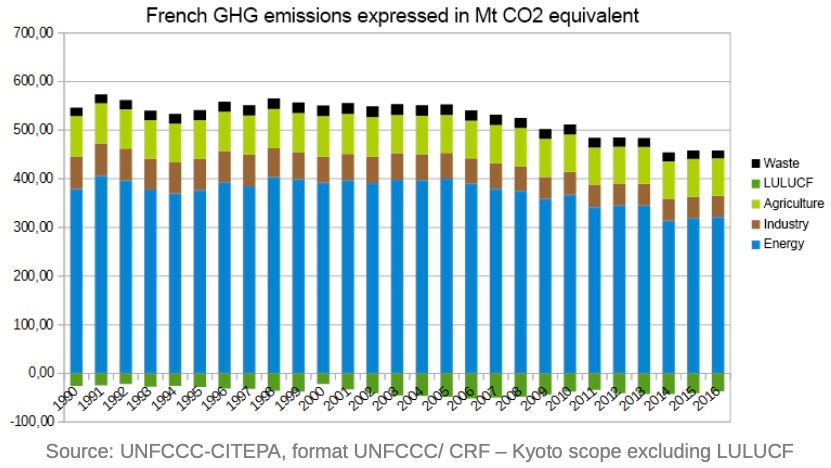

EU notebook: Energy ministers rush to boost gas supplies ahead of Russian cuts

. . . . European energy ministers agreed this week to require 80% gas fuel storage by November in the expectation that Russia will continue to choke, or completely cut supplies this winter if the war in Ukraine persists, writes Alisha Houlihan from Dublin. While political conditions are deteriorating, gas storage is already up more than 50% over previous years as companies fret about potential cuts. Plus, France said its national emission-cutting plans are on track, despite a bump last year as the economy began to recover from Covid. . . .

Thursday’s subscriber insights: What recession? Tracking the renewables jobs boom

. . . . With the world worrying about recession and rising energy prices boosted by the Ukraine war, it’s kind of easy to forget that the renewables revolution is in full swing, with accompanying jobs, big business deals and more starting to grow. New numbers show that jobs in the electric vehicles sector, in particular, are surging, while jobs in wind and solar are also on the rise. Despite surging oil and gas prices, though, jobs in the sector continue to fall. Read more here. . . .

. . . . It turns out Captain Kirk/William Shatner is double trouble when it comes to the environment. First, he commanded the Enterprise, which no doubt caused huge amounts of pollution and then he went on a Jeff Bezos-funded Blue Origin. It turns out that carbon released at high altitudes has a much bigger effect than that emanating on or near the Earth’s surface. Time to cut back on the “boldly go where no one has gone before”? Read more here. . . .

. . . . Live in the suburbs with a nice two-car garage? That means you can set up an EV car-charger quite easily. But what if you have a space in an apartment complex or a studio in the city? Well, GM is planning to solve that. Read more here. . . .

. . . . This butt’s for you. A Singapore brewery is flush with success after introducing a beer made from recycled toilet water. It’s described as a refreshing, light-tasting ale that’s perfect for the city state’s tropical climate. Read more here. . . .

Editor’s picks: Iron ore shortage hurts steelmakers’ efforts to go green

High-quality iron ore shortage threatens green steel

Supply problems with high-quality iron ore could threaten steelmakers’ efforts to reduce their carbon emissions. Taylor Kuykendall reports in S&P Global Market Intelligence that while green hydrogen-based technologies use less carbon to produce steel, the process requires higher iron ore grades than traditional blast furnaces. The report cites the Institute for Energy Economics and Financial Analysis as saying a shortage of ore with an iron content above 65%, combined with a shortage of mining projects in the pipeline, could disrupt the industry’s environmental goals. Steel accounts for 7% of energy sector CO₂ emissions, according to the International Energy Agency. Automakers are among those pushing for greener steel operations, according to the report.

Understanding hurricane fatalities

Analyzing deaths in the U.S. caused by hurricanes between 2017 and 2021, researchers say they now know that indirect deaths outnumbered direct deaths by 299 to 271. Almost 30% of the indirect deaths were the result of disruptions to the power grid. People also died from electrocution, carbon monoxide poisoning, vehicle incidents and heat-related causes. The new data from the National Hurricane Center, as reported in Yale Climate Connection, is changing how scientists and emergency planners assess the risk of hurricanes, including “signs evident that human-produced greenhouse gasses may be enhancing rainfall from some tropical cyclones.”

Latest findings: New research, studies and projects

Financing nature

Biodiversity conservation will eclipse climate change risk mitigation and adaptation as the next grand challenge for sustainable finance, write the authors of Biodiversity Finance: A Call for Research into Financing Nature. From the abstract: “Closing the financial gap between what is currently spent and what is needed to be spent over the next 10 years to mobilize private investment to maintain ecosystem integrity and biodiversity, and the services they provide, is estimated to exceed hundreds of billions per year. Yet there are no studies in the top tier journals in Finance that have framed the risks related to biodiversity loss, how those risks might be priced, or how the private financing flows need to be intermediated. The authors lay out one framework and outline important open research questions for financial economists to pursue.” Authors: George Andrew Karolyi, Cornell University SC Johnson College of Business; John Tobin-de la Puente, Cornell University Charles H. Dyson School of Applied Economics and Management.

More of the latest research:

Words to live by . . . .

“To make progress on climate, we need systemic change, not incremental change. Every business and every person has a role to play in that.” — Hendrith Vanlon Smith Jr., CEO of Mayflower-Plymouth Capital.