The case against taxing electric vehicle mileage, plus ESG markets have strong June

Welcome to Callaway Climate Insights. Please see our special July 4th offer below for subscriptions at just $5 a month.

The Nasdaq’s announcement Tuesday of a new ESG Data Hub for investors, powered by data from a half-dozen growing pioneers, caps a record June for market activity around carbon and environmental trading patterns.

In Britain, the new UK carbon contracts on the Intercontinental Exchange (ICE) have seen rising volume and reduced spreads from the European contract, and raised almost £800 million ($951 million) for the British government.

“Participation is good,” said Gordon Bennett, managing director of utility markets at ICE, in an interview last week. “The spreads tightening is the market becoming more comfortable with where the market is for UK (carbon) allowances.”

The UK contract traded this week at about £46 ($63.70) per ton, compared to €55 ($65.43) for the European contract. Bennett said trading volume in ICE’s California carbon contract, the most popular in the U.S., is at a record in June. Not to be outdone, Chicago’s CME Group said it would launch a “nature-based” offset futures product on Aug. 1.

The new products are in response to increased demand from hedge funds, banks, corporate compliance departments and other large investors for ways to hedge against greenhouse gas emissions. Pushing the prices of carbon and other offsets higher makes it more expensive to pollute and easier to transition to renewable energy.

As governments dither, the markets are starting to point the way forward.

Special offer: Subscribe to Callaway Climate Insights between now and July 4 for a special rate of only $5 a month, good through the rest of the summer. And get all of our premium insights delivered to your inbox four days a week, plus special access to our ‘Countdown to COP26’ event in September, with EU Climate Commissioner Frans Timmermans.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Don’t tax me, don’t tax thee, don’t tax EV

. . . . A proposal to tax electric vehicles by the mile as an alternative to gasoline taxes is creating strange bedfellows in Congress and hurting the potential to move drivers to EVs at precisely the wrong time, writes Bill Sternberg from Washington. While the proposal didn’t make it into the latest infrastructure agreement, support in both parties for it is causing concern as it seemingly goes against the ultimate goal of reducing fossil-fuel pollution from cars. Bill makes the case against. . . .

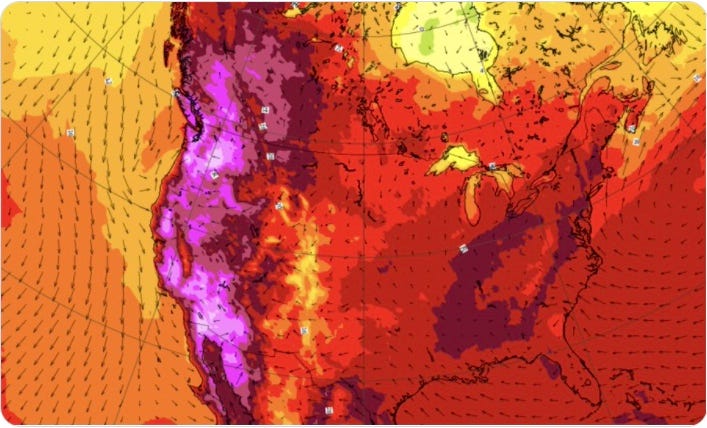

Tuesday’s subscriber insights: Heat waves cook up an air-conditioning vicious cycle

The World Meteorological Organization says: “Less than 24 hours after smashing Canada’s national high temperature record, Lytton, B.C. broke it again, with 47.9°C. (118.2°F.)on Monday. This is in British Columbia, home to the Rockies and the Glacier National Park.”

. . . . The record heat in the Pacific Northwest this week is leading to a run on air conditioners in a region well known for its ability to do without because of its temperate climate. Driven by demand there and in other unusual places such as the UK and Northern Europe, as well as heat-prone Asia, air conditioner power usage is expected to triple by 2050, creating a vicious pollution cycle, but also huge opportunities in more efficient cooling systems. Read more here. . . .

. . . . While U.S. politicians talk about taxing electric vehicles, European ones are creating subsidies and tax incentives to move their driving populations to EVs. The results are a 60% rise in EV sales in the past five years and a 12% drop in total auto emissions in 2020. Read more here. . . .

Editor’s picks: Nestle invests in local water sources; and does working from home really save energy?

Nestle Waters invests in local water cycles

Nestle SA said today it will invest about $130 million in projects to help regenerate the ecosystems in the areas around each of Nestlé Waters’ 48 sites. As of 2025, they will help nature retain more water than the business uses in its operations, the company said. Nestle said the project is part of its goal to get all of its water sites certified by the Alliance for Water Stewardship. The project includes land conservation, river restoration, support for farmers to use drip irrigation and the delivery of water treatment, filtration and pipeline infrastructure for municipal water supplies.

Is working at home as green as some think?

Last month, the European Commission, the union’s executive body, announced it will close half its office buildings. The rationale behind this, according to Johannes Hahn, the European Commissioner for Budget and Administration, is to adjust to the new post-Covid norm of working from home and to make the Commission “more green” by reducing building emissions, Energy Monitor reports. According to the plan, closing offices and cutting commutes could reduce emissions, but EM notes the data are less clear cut. According to the report, whether the change creates emissions savings depends on local transport and energy provisions. “In many instances, teleworking causes more emissions because each individual worker’s home needs to be powered, heated and air conditioned, rather than just one shared office space.” The commission employs 32,000 people and plans to reduce its 50 buildings around Brussels to 25 within the next 10 years.

JPMorgan Chase acquires OpenInvest

JPMorgan Chase & Co. (JPM) said today it is acquiring OpenInvest, a sustainable investing-focused financial technology company, in an effort to accelerate ESG investing capabilities for its wealth management clients. Mary Callahan Erdoes, CEO of J.P. Morgan Asset & Wealth Management, said in a statement, “Clients are increasingly focused on understanding the environmental, social, and governance (ESG) impact of their portfolios and using that information to make investment decisions that better align with their goals.” JPMorgan says OpenInvest will retain its brand and the company will be integrated into J.P. Morgan’s Private Bank and Wealth Management client offerings.

Sign up for all our insights, news and columns with the summer sale: $5 a month

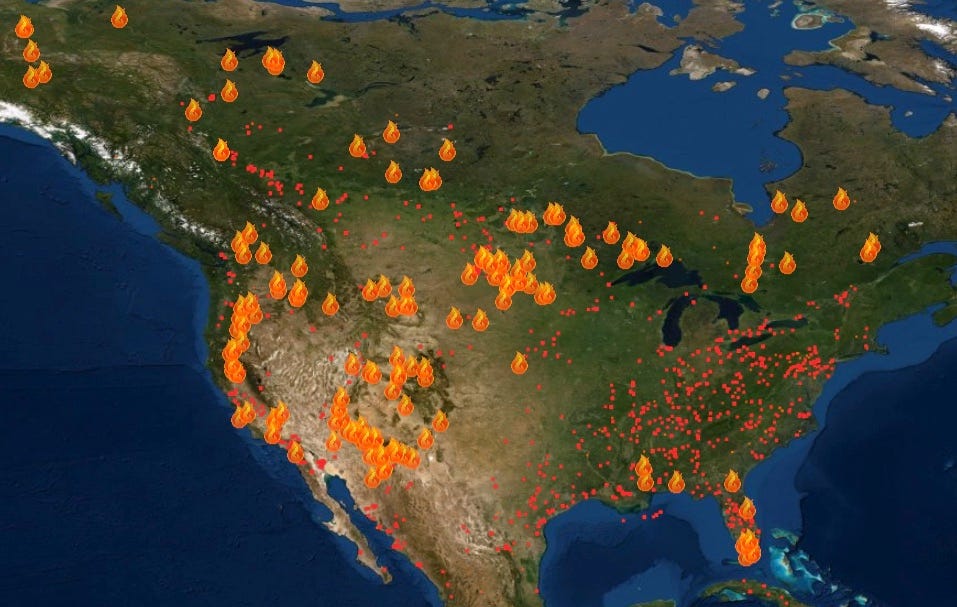

This week in wildfires

. . . . As of June 29, the Fire Information for Resource Management System reported three new large incidents in the U.S. and Canada, four large fires contained, and 36 large fires uncontained. In the southwest, 17 new fires were reported, and 12 uncontained large fires. In the Southern California area, 34 new fires were reported and there were four uncontained large fires. Across the nation, the National Interagency Coordination Center reports as of Wednesday morning, more than 692,517 acres had burned. . . .