The Fukushima question; and the SEC’s shot at climate deniers

Welcome to Callaway Climate Insights. It’s a day of anniversaries, and our own is just around the corner. Please enjoy and share.

By now you’re no doubt tired of reading about the one-year anniversary of the Covid lockdown, the 10-year anniversary of Fukushima, the 17th anniversary of the Madrid train bombings, or the 90th anniversary of Rupert Murdoch. Of these, only one is a lasting threat, or promise.

I was running MarketWatch 10 years ago when the earthquake off of Japan’s northeast coast triggered a tsunami that killed 18,000 people and set off the Fukushima nuclear crisis. A separate tsunami went east toward the U.S., and we all arrived at the newsroom in San Francisco at 6 a.m. the next morning to observe what had by then been reduced to just a ripple, rocking sailboats in local ports.

But the effect on nuclear energy worldwide was more than a ripple. Japan, China, Germany and others immediately ceased nuclear operations and only China is now moving back in, as the prospect of cheap nuclear energy makes sense amid global goals to slash fossil fuel emissions. Eastern Europe also is sticking with it, and a trend toward smaller, more manageable nuclear power stations is developing elsewhere.

Nuclear energy isn’t going away, but the debate will continue to grow. I strongly suggest you read the two links published today for the anniversary, here and here. One is by The Economist, supporting safe, regulated use of nuclear energy. The other is by The Bulletin of Atomic Scientists, which argues there is reason for “extreme pessimism” about whether nuclear power plants can ever be safe, at least in Japan, given its earthquakes.

I’m interested in what you think, so please let me know. My own view is that if Covid and/or global warming have taught us anything, it’s that we can never be fully prepared for impending disaster. So we must work to cut our risks as best we can. Nuclear power has a role in the mix, but we have not yet defined it adequately.

As for Fukushima, where some areas are still uninhabitable 10 years later, the prefecture has become a leading source of solar energy, as well as home to one of Japan’s largest green hydrogen plants. Its vote forward is cast.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

EU notebook: Europe’s proposed carbon border levy hits roadblocks

. . . . A controversial practice by the European Union to hand out carbon credits to heavy polluting industries narrowly passed the European Parliament this week, writes Vish Gain from Dublin. The practice runs head-long into EU plans for a carbon border levy, which will be voted on this summer and which has drawn charges from Asia that both practices together would constitute protectionism and violate World Trade Organization rules. Only one can survive.

Today’s insights: HBSC cuts coal financing; SEC eyes political spending

. . . . Expect to see a lot more buzz as spring’s proxy season arrives: British banking giant HSBC (HSBC) — currently a big lender to fossil-fuel industries and under considerable pressure from shareholders — has announced that it plans to bring a special resolution on climate change to be voted on at its AGM on May 28. Read more about what this could mean for HSBC’s bottom line and its plans to provide between $750 billion and $1 trillion in green financing and investment. . . .

. . . . At the same time as corporations are touting their green credentials, they quite often also are funding climate-deniers, lobbyists, political groups and politicians who are trying to block climate-change solutions. That could change after just-confirmed Securities and Exchange Commission chairman Gary Gensler indicated the agency would pressure companies to disclose their political spending activities. Read more about whether that could change climate investing or if it’s even practical. . . .

Fuel-cell stocks still in the green this year

. . . . FuelCell Energy Inc. (FCEL), which reports quarterly results next Tuesday, is up more than 50% for the year, while Plug Power (PLUG) is up by more than a third. Read more about the fuel-cell stocks, and earnings previews for EV, green tech and alternative energy companies coming up next week. . . .

Data driven: The need to help small business grow back green

. . . . As much as 70% of industrial pollution in the U.S. and EU comes from small and medium businesses, analyses show. These also are the enterprises hit hardest by the pandemic, and which are the least prepared for climate change. Read more about how helping small business grow back greener will help U.S. innovators in climate finance and technology, too. . . .

ESG investing: What are your motivations?

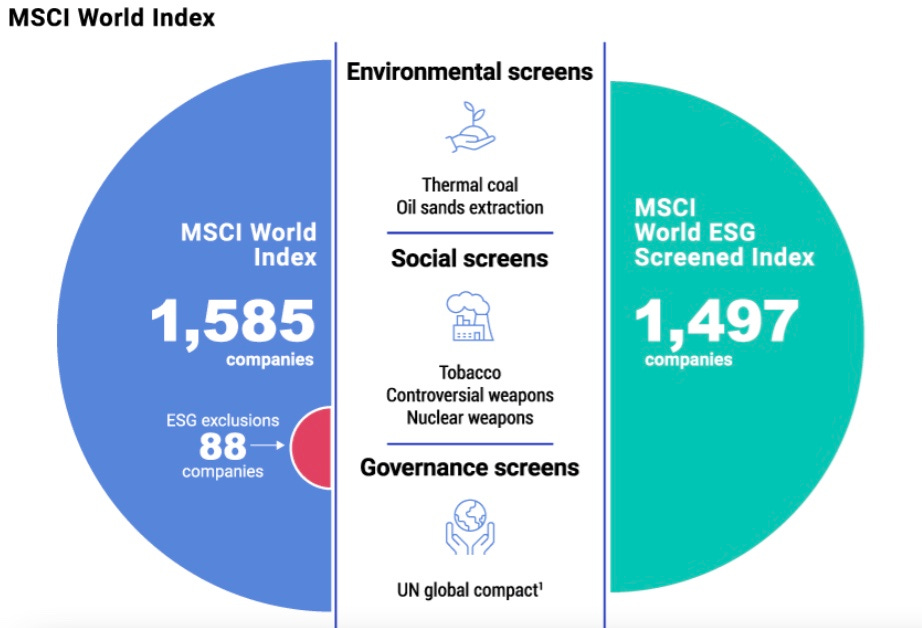

. . . . In a special report for Visual Capitalist headlined ESG Investing: Finding Your Motivation, Marcus Lu writes that MSCI has identified three common motivations for using ESG in one’s portfolio: ESG integration, incorporating personal values, and making a positive impact. ESG integration, Lu writes, refers to investors who believe that using ESG can improve their portfolio’s long-term results. Incorporating personal values involves aligning financial decisions with personal values. This can be achieved through the use of negative screens, which identify and exclude companies that have exposure to specific ESG issues, Lu notes. Visual Capitalist has illustrated the differences between the MSCI World ESG Screened Index and its standard counterpart, the MSCI World Index, as seen in the graphic detail above. The report notes that the MSCI World ESG Screened Index “excludes companies that are associated with controversial weapons, tobacco, fossil fuels, and those that are not in compliance with the UN Global Compact. The UN Global Compact is a corporate sustainability initiative that focuses on issues such as human rights and corruption.” Read more about ESG investing for a positive impact and how investors feel about ESG-related growth opportunities. . . .

News briefs: Lack of green Covid recovery spending; and a pipe activists will like

Editor’s picks:

UN report slams lack of green in Covid recovery spending

Activists won’t have a gripe about this pipe

Non! Kerry pounds nations over Paris pact progress

Words to live by . . . .

“This is the moment. Glasgow is the last, best opportunity that we have and the best hope that the world will come together and build on Paris. … Scientists tell us this decade, 2020 to 2030, must be the decade of action.” — John Kerry, Special Presidential Envoy for Climate.