Three surprises investors should watch for at COP28 next week

Welcome to Callaway Climate Insights. Take advantage of our holiday sale to send a gift subscription to your favorite clean energy investor.

Today’s edition is free. To read our insights and support our great climate finance journalism five days a week, subscribe now for full access.

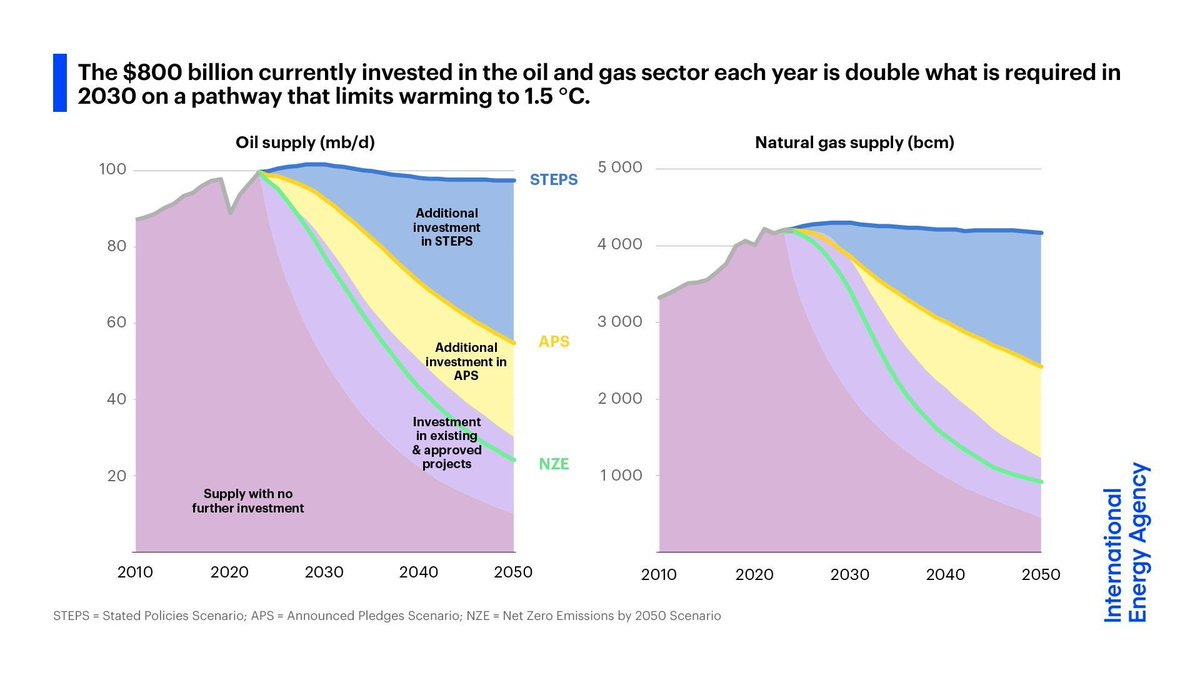

More than we need: While oil & gas production is far lower in net zero transitions, some investment in supply is still needed, says the IEA. The $800 billion currently invested in the sector each year is double what’s required in 2030 to limit global warming to 1.5°C.

With more than 70,000 people attending the COP28 climate summit in Dubai over the next two weeks, we can expect a lot of noise. Controversy, protests, perhaps even the occasional broad agreement on something like limiting methane leaks. But with much of the action on the sidelines of the official summit, investors will need to work hard to cut through the noise for ideas.

Day one started with an agreement to adopt a fund inside the World Bank to help poor nations handle climate disasters, and almost $280 million pledged immediately from the U.S., UK, EU, and Japan. Though billed as a quick win for UAE hosts, this was actually a managed victory. The fund had been agreed on weeks ago after arduous negotiations on where to house it. It was formally signed today.

Here are three real potential surprises we’ll be looking for in the coming days.

More exotic financing ideas for handling “loss and damages” for poor countries. BlackRock BLK 0.00%↑ kicked this off a few days ago with a report that recommends turning funding from large multinational institutions such as the World Bank into backstops for private investor money, limiting risks on emerging market debt bets. Incentivizing private money to come into this traditionally risky arena is the only way to achieve the scale governments need to make a difference.

While progress has been made in setting up a loss and damages fund inside the World Bank, without private money there just won’t be enough to cover the $1 trillion estimated to be needed, more than ten times the current fund size. Look for the World Bank’s Ajay Banga to make news on this next week after the global leaders depart this weekend.A coordinated carbon capture and storage strategy among oil states and the largest companies. With all the pressure on COP28 President Sultan Al-Jabar about turning the summit into an oil fest, the head of the UAE’s national oil company must complete a grand deal among Big Oil to succeed. Carbon capture and storage (CCS), one of the hottest subjects among investors but one that scientists say is still not scalable enough to reduce the emissions we need, is almost certain to be the centerpiece of such a deal.

We expect several major CCS “breakthrough” announcements in the next few weeks. Only a coordinated deal that includes an specific emissions reduction goal that all can follow will be considered a win. This area, however, is the best shot investors might have in identifying a technology, and company, to bet on in the next several months. One clue to a possible deal is that Exxon CEO Darren Woods is rumored to be coming next week, the first time for a Big Oil CEO at a COP event.A nuclear energy breakthrough, perhaps in fusion technology. This is known as the head fake strategy. As Al-Jabar seeks to deflect criticism from the oil jamboree he will oversee, making a big deal about advancements in nuclear energy seems a given. The idea of mobile or small nuclear generators suffered this year after a high-profile project between the U.S. Energy Department and NuScale, an Oregon company considered the leader in the technology, collapsed.

Any news of a revival of the deal or new deals would re-energize, so to speak, interest in the area championed by Bill Gates, among others. But why stop there? What would really turn investor heads would be any news of substantial progress in creating renewable energy through nuclear fusion (as opposed to the traditional fission), which is still largely untested.

There will be many, many other announcements and as usual the final deal between governments on loss and damage and whether to “phase out” or “phase down” oil will drag past the end of the summit and imperil everyone’s holiday plans. But for investors looking for ways to speculate on this year’s climate summit, these three areas seem to us to have the most potential.

Another good investment idea . . .

. . . . Best gift ever: Get ready for the holidays by giving your favorite climate enthusiast (or yourself) a subscription to Callaway Climate Insights. Just $120 (20% off) for an annual subscription with this holiday offer!

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

Why momentum investors don’t help fight climate change

. . . . Investors who rode the wave of clean energy stocks and ETFs in 2020 and — until this past month — have since been pummeled, should look no further than to the trend toward momentum investing, writes Mark Hulbert. Using the boom-and- bust tale of the iShares Global Clean Energy ETF ICLN 0.00%↑ , Hulbert shows how its spectacular gain and then fall was the result of a pack of momentum investors during Covid, and not a surge in investors wanting to fight climate change. To make the world greener and provide capital to the startups who need it to mitigate the impact of climate change and save the world, Hulbert suggests something more boring: green bonds. . . .

Guest commentary: How climate change, batting last, will defeat the capitalism that created it

. . . . The 20th Century was replete with examples of how big business and the theory of “growthism” — that profit mattered above all else — took a toll on hundreds of millions of people, from tobacco companies to the pharmaceutical industry. But nothing will compare to the damage done by a relatively small amount of massive oil and gas companies, writes author and contributing columnist Jacques Leslie. As another United Nations climate summit begins this weekend, Leslie walks us through what’s at stake in the war between nature and capitalism. Who bats last, and what we can still do about it. . . .

Thursday’s subscriber insights

Why there's no need to feel quite so guilty when you Google

. . . . Renewables enthusiasts have been saying it for decades — that one of the biggest possibilities to save the world is geothermal energy. And that avenue to excising pollution just got a big boost by the launch of America’s first “enhanced” geothermal plant, something backed by Google as it tries to reduce pollution caused by its huge data centers. Read more here. . . .

France's famed oysters are threatened by climate change

. . . . Olive oil, hops, truffles. All these treats are being affected by climate change. And now you can add another one: oysters. Yes, France’s massive oyster industry is being affected as the pools used to bring the bivalves to perfection are getting too warm. Aw, shucks. Read more. . . .

Editor’s picks: Rare U.S. wolverine may get climate help from Biden

Wolverines up for threatened species protections

Wolverines in the wild in the U.S. could finally get threatened species protections under a new Biden administration proposal. The Associate Press reports the move comes in response to warnings that climate change will likely destroy the rare species’ mountain habitat and push it toward extinction. The AP notes most wolverines in the U.S. were wiped out by the early 1900s from unregulated trapping and poisoning campaigns. About 300 surviving animals in the contiguous U.S. live in fragmented, isolated groups at high elevations in the northern Rocky Mountains. “Wolverines join a growing number of animals, plants and insects — from polar bears in Alaska to crocodiles in southern Florida — that officials say are at growing risk as increasing temperatures bake the planet, altering snowfall patterns and rising sea levels,” the report says.

Explain that: Future climate change

. . . . Current policies make it likely that global warming will exceed 1.5°C during the 21st century and make it harder to limit warming below 2°C, says the UN’s The Intergovernmental Panel on Climate Change. The IPCC’s Synthesis Report underscores the urgency of taking more ambitious action. According to the report, global warming will continue to increase in the near term (2021-2040) mainly due to increased cumulative CO2 emissions in nearly all considered scenarios and modeled pathways. “In the near term, global warming is more likely than not to reach 1.5°C even under the very low GHG emission scenario and likely or very likely to exceed 1.5°C under higher emissions scenarios. In the considered scenarios and modeled pathways, the best estimates of the time when the level of global warming of 1.5°C is reached lie in the near term.” Read more from the IPCC.

Words to live by . . . .

“How glorious a greeting the sun gives the mountains!” — John Muir.