UK puts the wind in windfall tax; plus, the SEC knows ESG when it sees it

Welcome to Callaway Climate Insights. Especially to new subscribers since the Dublin Climate Summit two weeks ago.

To read all our insights, news and in-depth interviews, please subscribe and support our great climate finance journalism. Callaway Climate Insights publishes Tuesdays and Thursdays for everybody.

I guess they don’t call it a windfall tax for nothing. As we predicted last week, the UK’s conservative government is going ahead with a one-time tax on more than 10 billion pounds ($12.5 billion) of what it calls “excessive” profits on oil and gas.

But Chancellor Rishi Sunak isn’t stopping with North Sea oil companies. His proposed tax will also hit broader electricity generating companies, including those who use wind power.

The argument is that huge profits from rising gas prices at the big utilities is also fair game, even for those doing good jobs of focusing on renewable energy.

Such is the impact of the growing inflation, energy and food crisis, that governments are starting to hunt for funding to pass along to their citizens.

This type of blanket power grab is even more insidious than a pure tax on oil profits, and will have a very predictable impact on investment in new forms of energy. Shares of electricity firms such as SSE and Centrica fell as much as 10% Tuesday in London on the news. Here in the UK, where Brexit is already exacerbating an economic slide toward recession, it also smacks of an increasingly desperate governing party.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Why Australia’s Albanese won’t be the new face of climate change

. . . . Australia’s new prime minister wasted no time promising voters he would make the global climate pariah a “renewable energy superpower” this week, but without immediate action on coal production this is just another of a long list of empty political pledges, writes David Callaway from London. Frustration over the country’s climate policies thrust Anthony Albanese and his Labor Party into power. How he responds on the next 30 days will be closely watched by climate transition advocates around the world. . . .

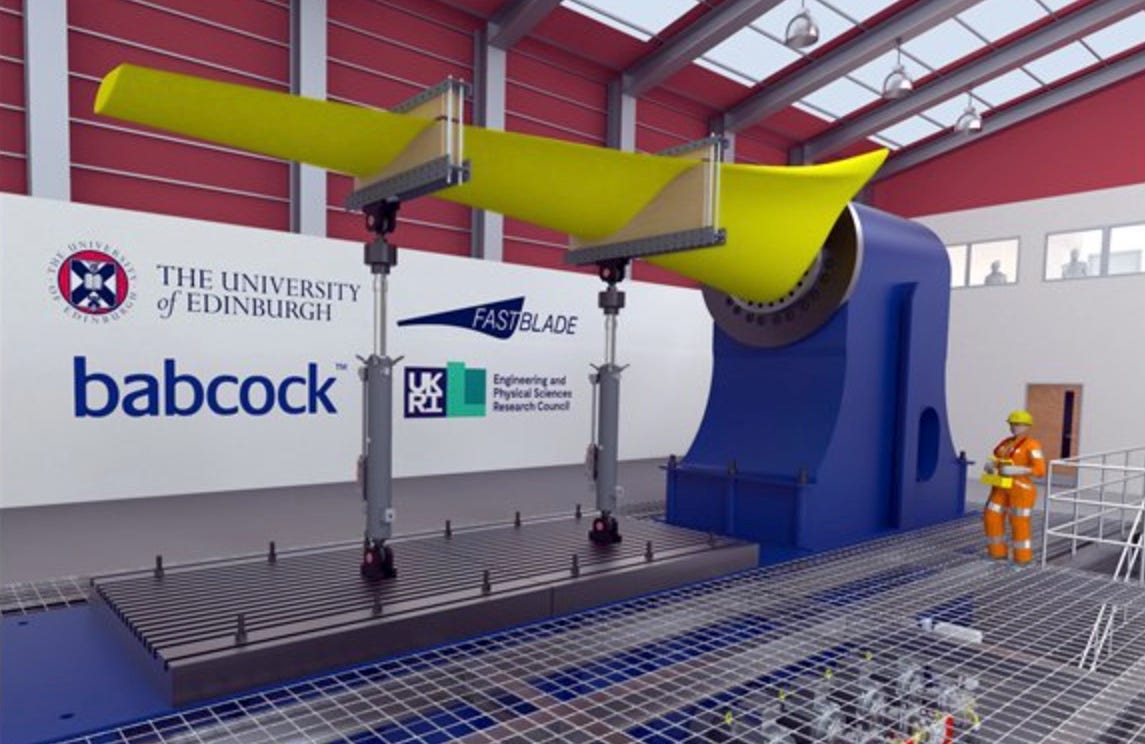

Tuesday’s subscriber insights: Big leap for tidal power potential

. . . . Anyone with any interest in renewables knows there is one near-perfect solution: tidal energy. But it hasn’t taken off in large part because of the harsh conditions that make it possible. Now there’s good news in the construction of a tidal testing facility in Scotland. We have details. . . .

. . . . At least the SEC knows ESG when it sees it. Amid all the headlines about environmental, social and governance investing collapsing in the last week, the regulator’s $1.5 million fine against BNY Mellon for mistaking and omitting certain information tied to its ESG products provides stark evidence that not everybody is on the fence. . . .

. . . . There are some fossil fuel companies that have reasonably good reputations when it comes to doing something about global warming — Shell, BP, TotalEnergies and Equinor among them — and some not so much (Exxon and Chevron come to mind). Now, Shell is being accused of saying one thing and doing another. What will be the fallout? . . .

. . . . A cautionary tale: Vietnam went all out for renewables — particularly solar — and then found its grid could not handle it, leading to massive waste. How did it happen and can the U.S. and other countries avoid the same mistakes? Read more here. . . .

. . . . France’s Burgundy region is known for its fine wines. And also for its fabulous Dijon mustard, named after the region’s capital city. But now climate change has made the hot condiment almost as rare as a 1929 Romanee-Conti. Read more here. . . .

Editor’s picks: Climate finance ‘turning point’; plus, an EV glossary

Climate finance’s turning point

Failure to act on climate change could cost the global economy $178 trillion over the next five decades, but action now that leads to net-zero emissions by midcentury could increase the size of the world economy by $43 trillion in net present value terms from 2021-2070. So says a new report titled The turning point, from Deloitte Center for Sustainable Progress issued Monday. “We have the technologies, business models, and policy approaches today to deliver rapid decarbonization and limit global warming to as close to 1.5°C. by century’s end,” say the report’s authors. “Economics is on the side of a low-emissions future,” the foreword states. “As governments, industries and financial markets continue to reallocate capital toward decarbonization, the world can accelerate to net-zero emissions and unlock the economic opportunity that comes with it.”

Electric vehicle glossary: Expand your range

Do you know your supercapacitor from your CHAdeMO? If you have an interest in EVs, are an investor in EVs, or plan on driving an EV (which seems very likely), you should. And now here’s a resource. Digitaltrends.com’s EV glossary: All of the electric vehicle jargon you need to know. Simon Sage writes, “What’s the difference between Level 1 and Level 2 charging? What makes a battery solid-state? How is MPGe calculated? This EV glossary will decode all the jargon you need to know to understand electric vehicles.” This guide is broken down into subjects, including classification definitions, part definitions, electrical definitions, mechanical and infrastructure and more.

Data driven: What’s in your pocket?

. . . . Lifecycle assessments show — taking cotton production, manufacture, transport and washing into account — it takes about 1,000 gallons of water (3,781 liters) to make one pair of jeans. The UN says the process equates to almost 74 pounds (33.4 kilos) of carbon equivalent emitted, like driving 69 miles or watching 246 hours of TV on a big screen. A thousand gallons of water is about what a normal adult would consume in five years. According to the report from the UN’s environment program, even just washing our clothes releases plastic microfibers and other pollutants into the environment, contaminating our oceans and drinking water. “Around 20% of global industrial water pollution is from dyeing and textile treatment. Yet globally, the [fashion] industry wields considerable power. It is worth $1.3 trillion, employing around 300 million people along the value chain.”. . .