Year of climate setbacks didn't faze green investors

Welcome to Callaway Climate Insights, your daily guide to global climate finance. Happy holidays. Was this newsletter forwarded to you? Please see our holiday sale and subscribe.

Looking for a great holiday gift for someone? For yourself? Look no further! Callaway Climate Insights is offering a terrific seasonal sale: For the rest of 2025, get 25% off a new one-year subscription. Click here: CCI 2025 Holiday Sale . . . . It’s a thoughtful gift and we appreciate your support for our climate finance journalism.

A year of attacks on green energy in the U.S. and legislative setbacks in Europe comes to a close in a few weeks with the White House making noises this week about shuttering the National Center for Atmospheric Research in Colorado, one of the national symbols of climate science.

But no White House stunts — including the bizarre merger today of Trump Media with a fusion company — or attacks managed to phase investors betting on the green energy revolution this year. Despite relentless attacks on offshore wind energy and other green projects set up under the Biden Administration, renewable energy stocks have for the most part climbed to new highs.

The AI frenzy on Wall Street propelling a race to build more data centers using more energy boosted not just tech stocks but dragged many green plays higher with it, to the point where they are almost more important to the future of AI technology than the potential of AI itself.

Companies such as First Solar (FSLR), GE Vernova (GEV), Albemarle (ALB), Constellation Energy (CEG), and surprisingly, Tesla (TSLA) all bucked the worst that politicians had to throw at them. And with Elon Musk, that’s saying a lot. Other companies didn’t fare as well but still ended higher without getting crushed by anti-green sentiment.

These types of companies benefit mostly from low interest rates, and with rates falling and looking to fall at least a bit more in 2026, it’s likely the rally will continue. Certainly, the AI energy story isn’t going away.

Elsewhere as the year ends, it’s not looking so promising. Both Mexico and Canada, each led by a climate advocate, backtracked on climate commitments in 2025. The rest of South America was tough as well, and Europe buckled only a few weeks ago on what had been years of advancing climate legislation.

But in financial terms, the light of the season is still going. Just this week, Dutch pension fund manager PME ended its $6 billion relationship with BlackRock BLK 0.00%↑, which at one point had been a leading climate investor before retreating in the face of hostile politics. And New York City itself is debating the future of its $42 billion in pensions with the largest fund manager.

In fact, a survey this week from FTSE Russell found that more than 85% of asset managers are concerned about the impact of climate risk on their investments, up from 76% last year and 50% in 2023.

The pendulum swings year to year but there are still those committed to helping the world mitigate global warming, hedging climate risk, and making money at the same time. Happy holidays to all of you who are out there.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Editor’s note: Thanks for another great year. We’ll be back in your inbox on Monday, Jan. 5.

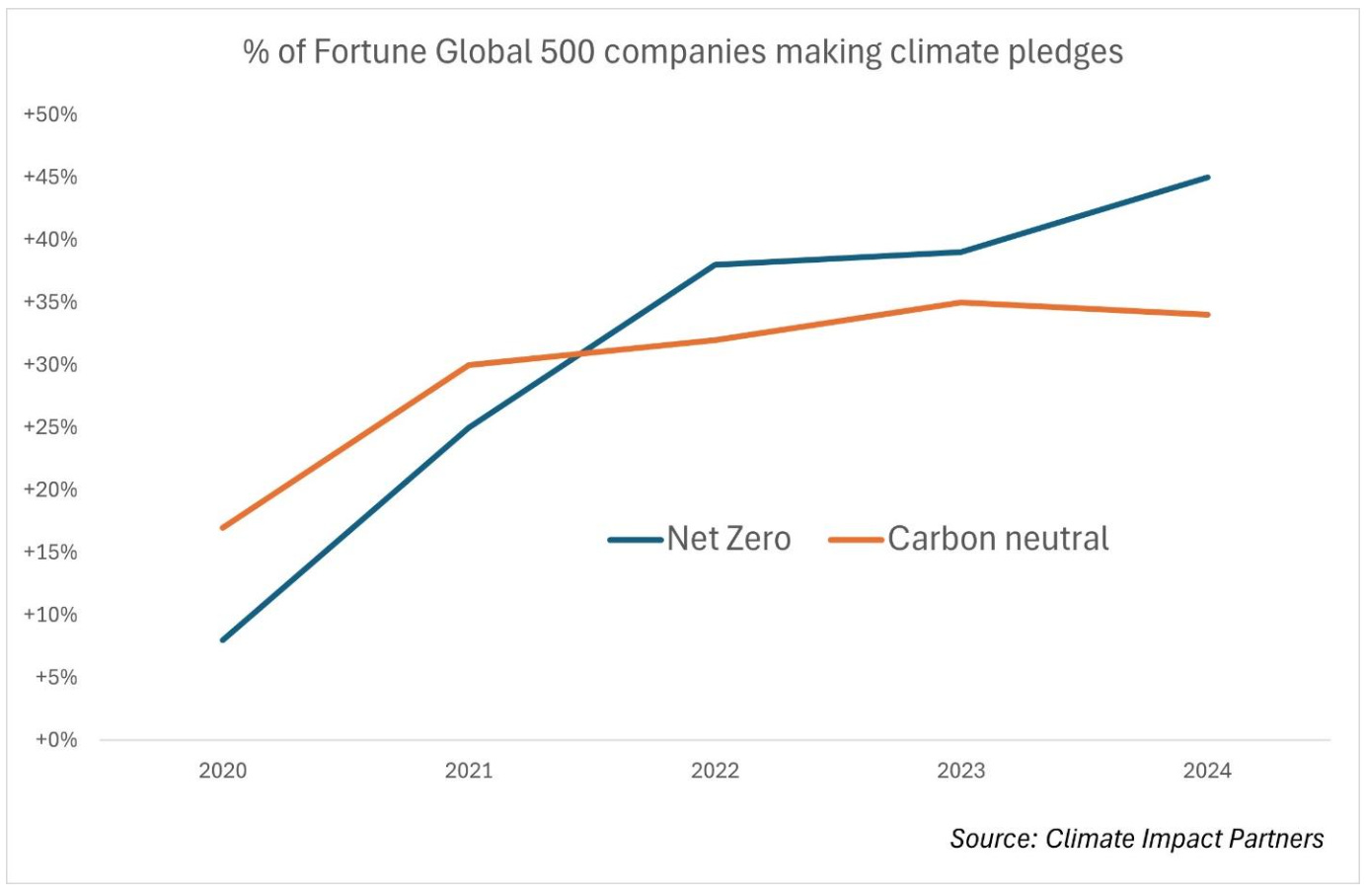

What a company’s climate pledge really means

. . . . What’s the difference between “net-zero” and “carbon neutral?” How about “climate positive” and carbon negative?” That’s the marketing puzzle Mark Hulbert explains this week to investors, including which of the dozen or so terms for helping reduce harmful carbon emissions is being adopted the fastest by companies. The confusing jargon and lack of universal standards for climate pledges is all part of the confusing marketing that often veers into greenwashing, where companies try to describe themselves as doing more than they are, according to Hulbert. It’s important for investors to understand the definitions behind each of the labels so they can hold companies to account for their pledges, and what they are doing versus saying. . . .

Thursday’s subscriber insights

Ford’s future as a battery storage company

. . . . Ford’s F 0.00%↑ retreat from electric vehicles this week was a long time coming. At one point, it was losing $35,000 on every EV sold as it struggled to contain production costs even when its Mustang Mach-E and F-150 Lightning were selling well. So why are investors now told that Ford will become a battery storage company?

The announcement of the plan to shift from all-electric vehicles to hybrids, in keeping step with General Motors GM 0.00%↑ and Stellantis, was tempered by the addition of a clever play on the AI craze. Ford will redevelop one of its plants in Kentucky to produce lithium iron phosphate batteries for AI data centers, taking on Tesla TSLA 0.00%↑, which is already well along the path to being an energy company.

The retreat is less about shifting back to gas-power than it is about admitting that it overspent on EV production, but Ford’s investors don’t seem to mind. Its shares are up more than 37% year-to-date, as White House attacks on the EV industry benefited those who also sell high-pollution gas vehicles. Ford may overspend, but its products are first-rate (I own a Mach-E) and consumers will still flock to whatever it makes. Hybrids are very popular for those not quite ready to make the EV leap.

The AI battery play seems completely out of Ford’s skill set, however. More of an attempt to get a piece of the AI market frenzy before it finally topples under its own weight than a strategic shift to an adjacent market. It does, however, plant another flag closer to the peak of the AI rally for nervous investors.

Elon Musk and Tesla are probably not shaking in their boots at the idea of new competition from Michigan. Though its shares are only up about 18% this year, Tesla remains firmly in the electric camp, betting its future on EV robotaxis. In the end it will come down to price for each of these companies, no matter what the marketing strategy.

Editor’s picks: New York, the Big Oyster; plus, coal demand plateaus

Watch the video: New York Harbor wasn’t always the polluted waterway we know today. Centuries ago, over 220,000 acres of oyster reefs thrived in these waters, filtering the harbor and supporting a vibrant marine ecosystem. But over-harvesting, dredging, and pollution wiped them out completely. Now, an ambitious initiative called the Billion Oyster Project is bringing them back — one shell at a time.

Global coal demand plateaus

Global coal demand is forecast to edge down through the end of this decade as competition intensifies with other power sources, including renewables, natural gas and nuclear, according to the 2025 edition of the IEA’s annual market report. The IEA says global coal demand is on course to rise by 0.5% in 2025, reaching a record 8.85 billion tonnes. In the U.S., higher natural gas prices and policy measures that slowed coal plant retirements lifted coal consumption, which had been on a downward trajectory for the previous 15 years. After two years of double-digit declines, coal demand in the European Union shrank only modestly. At the same time, in China, coal use remained broadly unchanged from its 2024 level. By 2030, however, global coal demand is expected to have ticked lower, returning to the same level as in 2023. This is largely driven by shifts in the power sector, which accounts for two-thirds of total coal consumption today, according to the report.

Latest findings: New research, studies and projects

Peak glacier extinction in the mid-21st century

Projections of glacier change typically focus on mass and area loss, yet the disappearance of individual glaciers directly threatens culturally, spiritually and touristically significant landscapes. Those are some of the conclusions of a new article published this week in the journal Nature. The authors, using three global glacier models, project a sharp rise in the number of glaciers disappearing worldwide, peaking between 2041 and 2055 with up to about 4,000 glaciers vanishing annually. Regional variability reflects differences in average glacier size, local climate, the magnitude of warming and inventory completeness. Authors: Van Tricht, L., Zekollari, H., Huss, M. et al.

Words to live by . . . .

“I prefer winter and fall, when you feel the bone structure of the landscape. Something waits beneath it; the whole story doesn’t show.” — Andrew Wyeth