China wins Climate Week; and why it might pay to buy the polluters

Welcome to Callaway Climate Insights, and happy Climate Week. Lots of action this week, so enjoy and please share with your friends and colleagues.

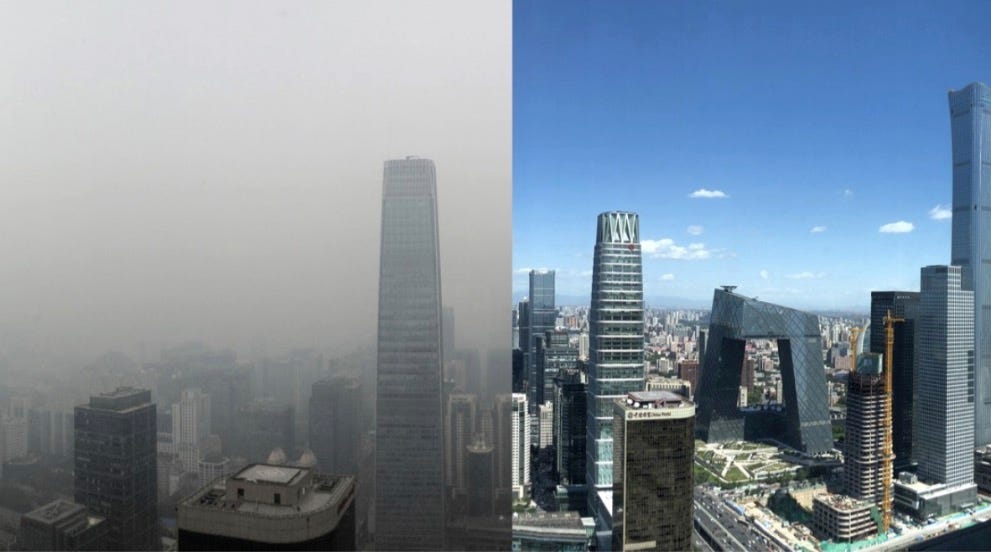

Above, an image from the South China Morning Post illustrating pollution that chokes Beijing (2018), in contrast with clear skies. The problem, worse in winter, stems from coal-burning plants as well as household emissions.

Call it the mother of all climate pledges. China President Xi Jinping’s promise to the United Nations this week that his country, the world’s biggest polluter, would go carbon neutral by 2060 shook Climate Week in New York. It’s still just a pledge, though.

Aside from the obvious diss to President Donald Trump in his own backyard, Xi offered the prospect that if true, China could make a huge difference in the next few decades. Scientists said China’s goal, when combined with European Union green strategies, could help the world achieve up to two-thirds of the reductions it needs to meet its target of keeping the increase in global average temperature to well below 1.5°C. by 2050.

Critics were quick to point out that China is still building coal plants at rapid levels and that it is, well, China after all — a country Alan Greenspan once joked had the unique ability among superpowers to report its economic growth numbers only one day after a quarter ended. But China’s real challenge is reducing its dependence on oil and gas, much of which it has to import. It has coal, and can use it to drive energy for a renewable transition. It already leads in electric vehicles, so if it wants to step into the role of climate transition leader it could. This is a country that once ordered all its families to just have one child, remember.

Still, the pledge is nothing without details. Fortunately, we might not have to wait long. My friend Bill Bishop, author of the Sinocism newsletter, pointed out last night:

The good news is we should have much better visibility in just a few months, as the 14th five-year plan will be released early next year. If that plan includes a clear roadmap to at least the 2030 goal then that will be great for China, and for the world.

More insights below. . . .

And don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

ESG investors betting on the wrong horses

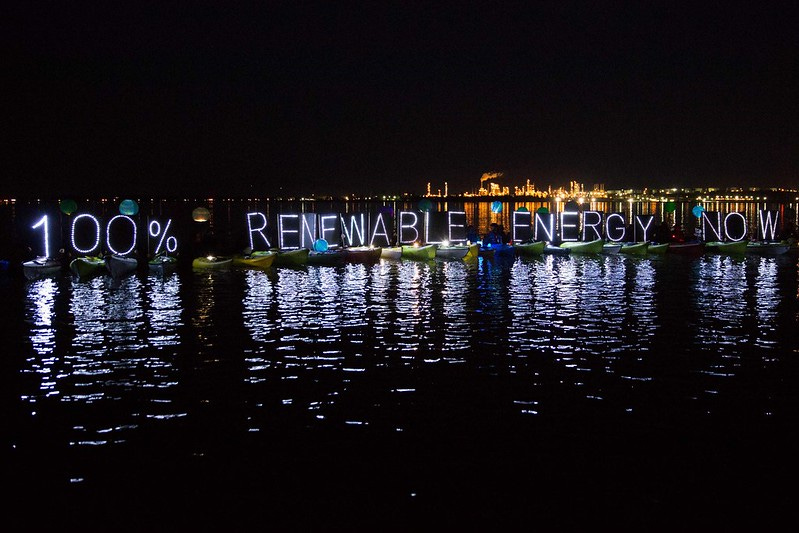

Above, LEDs spell out 100% Renewable Energy Now, with a refinery in the background at a protest against fossil-fuel transport. Photo: Backbone Campaign/flickr.

. . . . Pollution play: ESG investors who really want to make a difference in the climate space should put their money in polluters rather than clean technology, writes Mark Hulbert. That’s the surprising conclusion of two European finance professors who just released a paper on the impact of socially responsible investors on corporate behavior. Martin Oehmke and Marcus Opp argue that the greatest impact can be made by investors influencing big energy companies to transition to renewable strategies, not divesting their shares, for example. The report flips the ESG argument on its head, and also portends an even harder slog ahead for the idea of investing to do good.

We need to give up the false ideal of investment purity and focus instead on the complicated and often messy task of changing corporate behavior. That involves hard choices and difficult cost-benefit calculations. We might be doing the climate more good by investing in an egregious polluter if, in the process, we nudge it in the direction of being less egregious. . . .

ZEUS: Getting more from wind power with Uptake’s Sonny Garg

. . . .Windfall: Artificial intelligence and machine learning are revolutionizing almost ever industry, and renewable energy is no different. Sunil “Sonny” Garg, energy lead at Chicago data analytics company Uptake Technologies, explains how even small efficiencies brought to the maintenance and development of the nation’s 50,000 wind turbines can result in massive amounts of more energy, and profit. David Callaway writes that Uptake, founded six years ago by Groupon co-founder Brad Keywell, is betting on renewable energy as one of its three major business lines.

Wind power, more than solar, lends itself to AI in that there is more “down time”’ to improve on. And as a more nascent industry, it can grow along with advancements in machine learning, instead of needing to restructure or re-regulate. As renewable energy surpasses coal this year in the U.S., data will play a bigger role in how the dynamic electric grids of the future are designed. . . .

Above, evening traffic along Interstate 80 in the San Francisco Bay Area. Photo: Eric/flickr.

. . . . Playing politics: It’s telling that California Gov. Gavin Newsom’s announcement this week that the state would ban sales of new gasoline-only-powered vehicles by 2035 caused such a political dust-up. If the nation’s largest auto market, set in its biggest climate disaster area, can’t move to hybrids and electric vehicles in the next 15 years, we’ll have a lot more to worry about than autoworkers jobs. At present, electric vehicles represent just about 4% of the U.S. fleet. In a decade, it should easily be the majority. Fifteen years ago, we didn’t have iPhones yet. Technology changes faster than politics. . . .

. . . . Climate Week: Hats off to two enterprising women from The Cooper Union in New York’s East Village, who have led the college’s Climate Week efforts with a star-studded ensemble of speakers, including former Irish President Mary Robinson. Last year’s speakers included climate activist Bill McKibben, and Varshini Prakash, founder of the Sunrise Movement. Sophie Schneider, 23, a mechanical engineering graduate from the San Francisco Bay Area, and Alisa Petrosova, 21, from the Los Angeles area, who will graduate next year with an art degree, staged the events for the second year.

Mary Robinson seemed to us a great get, as they say in the media. Schneider said she was attracted to Robinson’s Mothers of Invention podcast, which features interviews with famous women on climate change issues, after hearing it earlier this year. So the two reached out and she agreed to appear via video.

In her panel Thursday morning, Robinson praised European Union President Ursula von der Leyen for her work in crafting a Covid-19 recovery budget that is about a third tied to green investments but said the real challenge will be pushing the fossil fuel companies to invest in transitioning their strategies, including their workforces.

“We have to look to those who were most responsible for far more change,” Robinson said.

Schneider and Petrosova produced the events, which started last week, to include both students and the speakers. Petrosova said they want to foster an “intergenerational” approach because the climate issue is going to change in importance as it passes from one generation to the next. The women said they were both influenced about climate change by specific engineering and art classes they took at the school, and the events program has a very artsy theme to it, which adds to its allure.

“I’ve never felt so much anxiety about climate change as I have in the last month-and-a-half,” said Schneider, on a phone call from her family home in San Francisco, a region which has been beset with wildfires and extreme heat and smoke. “Thinking of solutions and hope is keeping me going.”. . .

. . . . Playing politics, Part 2: As of this writing, the first presidential debate next week between President Donald Trump and Sen. Joe Biden will not include any questions about climate change. Despite calls from Sen. Edward Markey (D-Mass.), who is re-inventing himself as an environmental progressive, and 36 other Democrats this week, the debate will stick to other themes, such as law and order and Covid-19. As I wrote a few weeks ago, climate tends to fall in priority during big elections. Even in this wild year of fires and smoke and heat and hurricane, the moderators can’t find room for it. Expect Biden to say a few things in his statements, but for true debate on climate, we will have to wait. . . .

European notebook: Norway's Longship hailed as carbon capture milestone

. . . . Viking spirit: Norway’s Longship carbon-capture program, the nation’s second attempt at a massive capture and storage of carbon to help reduce greenhouse gases, was hailed this week as a North Star for Europe in its climate mitigation efforts, write Elizabeth Hearst and Dan Byrne. Named for the Viking warships, the project would include carbon capture at a cement factory in the southern part of the country, and a storage agreement between state energy company Equinor, and oil giants Shell and Total. The original carbon effort failed because of cost overruns. But Norway politicians say Oslo has the funds this time.

Energy Minister Tina Bru said, “Longship is the greatest climate project in Norwegian industry ever. We will cut emissions, not progress.”. . .

Data driven: Energy to burn

Global CO₂ emissions from fossil fuel combustion so far this year: 26.5 billion tons.

Source: International Energy Agency statistics; U.S. Energy Information Administration. (As of noon PDT Sept. 24, 2020) Above, a refinery in Alberta, Canada. Photo: Kurt Bauschardt/flickr.

News briefs: California to ban sales of gas vehicles in 2035

Editor’s picks:

California aims for all zero-emission vehicles by 2035

Oil producers in no-win scenario as prices stall

How global warming is fueling U.S. fires

Latest findings: New research, studies and projects

The Virtual Reality Climate Research Simulator has been developed by the Climate Change Institute. It uses the new medium of VR technology to help research and give people a better understanding of the challenges involved with tackling climate change.

Higher returns when invested in sustainable funds

According to Schroders Global Investor Study 2020, higher returns, rather than just the positive societal and environmental impacts are driving Americans’ adoption of investing in sustainable funds, with 55% of Americans being more likely to invest in sustainable funds for their more attractive return profile. This study of more than 23,000 people who invest from 32 locations globally, including 2,000 in the US, also found that only 4% cited they will not invest in sustainable funds due to a perception that they would offer inferior returns — this is down from 27% in 2018.

More research . . . .

UK lockdown: Nitrogen dioxide halved but sulfur dioxide doubled — A University of Liverpool study of air pollution in the UK during the first 100 days of the coronavirus pandemic lockdown has revealed that while nitrogen oxide levels were cut by half, levels of sulphur dioxide increased by over 100%.

Nudging When the Descriptive Norm is Low: Evidence from a Carbon Offsetting Field Experiment — This paper provides insights to policymakers and practitioners on the use of social interventions when the descriptive norm is low as well as on the ability of nudges to affect experts.

Words to live by . . . .

Climate change “is now rapidly becoming a comprehensive catastrophe that will dwarf the impact of the coronavirus pandemic. … At this late stage I can see no other way forward but to call for a Marshall-like plan for nature, people and planet.”

— HRH The Prince of Wales, speaking at the opening ceremony of Climate Week in New York.