Clean tech stocks make a move on rates and China, and ahead of COP28

Welcome to Callaway Climate Insights. We're able to provide this investment analysis because of your contributions. Please enjoy, share, and subscribe.

Today’s edition is free. To read our insights and support our great climate finance journalism five days a week, subscribe now for full access.

The U.S.-China renewable energy deal this week, predicted by Callaway Climate Insights, couldn’t have come at a better time for clean tech investors.

President Joe Biden and Xi Jinping’s commitment to tripling renewable capacity not only breathes life into what was a dying COP28 summit outlook in Dubai in two weeks, but arrives just as investors are driving a powerful recovery rally in global stocks based on the prospect that the era of high interest rates and borrowing costs might be ending after two years.

The third quarter, which saw markets bottom on concern about higher rates, also saw the largest influx of investment in climate technology companies in almost two years, according to BloombergNEF.

Both the iShares Global Clean Energy ETF ICLN 0.00%↑ and the Energy Select Sector SPDR Fund XLE 0.00%↑ have surged in the past week, along with shares of companies such as NextEra Energy NEE 0.00%↑, which we hold, and First Solar FSLR 0.00%↑ , as investors reassess the prospect for big energy projects now that borrowing costs might fall.

The Biden Administration added to the impact by pledging an additional $6 billion this week to invest in the U.S. energy grid and electric battery development.

A couple of week’s gains does not a major rally make. But the prospect of a changing rate cycle, plus the best climate investment talk in more than two years from both of the superpowers, certainly presents the potential for a technical bottom to the renewables bear market. Whether delegates to COP28 can add to the excitement with some momentum in the nascent carbon capture business might still be a tall order.

But at least it raises the stakes for investors that a year-end rally is out there.

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

Follow us . . . .

Twitter | LinkedIn | Facebook | Instagram

It's not just Acapulco. Cabo, Mexican Riviera also threatened as climate batters beaches

. . . . The hurricane that flattened Acapulco last month was a game-changer, even in a year of global warming disasters, showing the power and unpredictability of climate-driven storms. But other Mexican vacation spots, such as Cabo San Lucas, have also been battered by storms, eroding beaches and making cruise lines nervous, writes Michael Molinski. Many of the beaches along the Mexican Riviera have lost vast amounts of sand, hurting their prospects for the tourism that keeps that part of Mexico’s economy running. Cruise ships are still coming, but a bad year or two could alter the plans of their passengers. And El Nino is just getting started. . . .

Thursday’s subscriber insights

Heat is havoc for farmers — and the hardest-hit are in the world's poorest nations

. . . . If you look at a list of per-capita GDP per country, 20 of the bottom 25 countries are in Africa. Which indicates that it needs all the productivity it can get. But a new report found that loss of labor on the continent caused by heat stress wiped out 4% of its GDP, something it cannot afford. Plus, other impacts from around the world. Read more here. . . .

A gale turns into a hurricane of woes for the offshore wind industry

. . . . Ørsted. Siemens. Vesta. The wind industry is in a mess, particularly the offshore sector. Why? Higher interest rates. Supply chain issues. Overregulation. A quick look at what’s going wrong. Read more here. . . .

Editor’s picks: Hottest month on record; plus, NY sues PepsiCo over plastic pollution

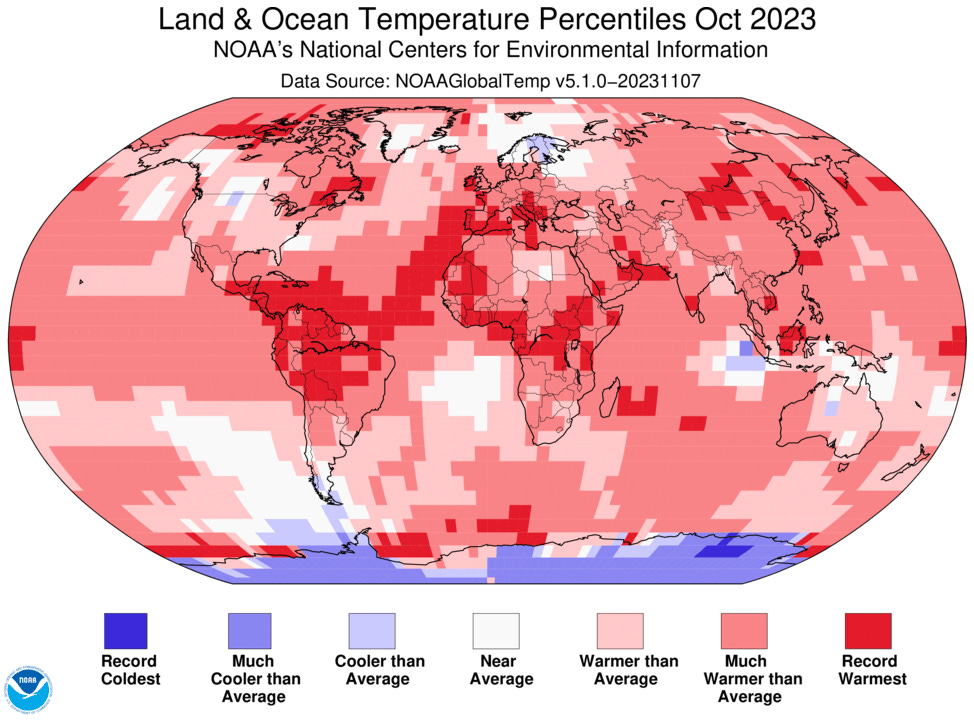

Last month was the hottest October – by far

Last month was the hottest October on record globally in analyses dating back to 1850, NOAA’s National Centers for Environmental Information said. NOAA, NASA, the Japan Meteorological Agency, and the European Copernicus Climate Change Service all rated October 2023 as the warmest October on record, crushing the previous October record by a huge margin, notes a report in Yale Climate Connections. Lest you think it’s just another broken record in a series of broken records… October global temperatures spiked to a 1.34°C. (2.41°F.) above the 20th-century average. According to the YCC report, using NASA data, October 2023 was 1.57°C. above the temperature of the 1880-1899 period, which is commonly called “preindustrial” (the difference between the 1951-1980 baseline reported on the NASA website and the 1880-1899 period is 0.226°C.).

New York sues PepsiCo over plastic pollution

The state of New York on Wednesday sued snack behemoth PepsiCo PEP 0.00%↑ over the deluge of litter that ends up in waterways that supply Buffalo with drinking water. The Associated Press reports that the lawsuit accuses the company, which is based in New York, and its Frito-Lay subsidiaries of creating a public nuisance by making a huge number of plastic bottles and wrappers that are discarded into the Buffalo River. By making so much plastic, the company is hurting the environment, the lawsuit says. According to the AP, PepsiCo said it’s serious about “plastic reduction and effective recycling,” but the company did not comment on the lawsuit’s claim that it was legally responsible for keeping garbage out of the Buffalo River.

Latest findings: New research, studies and projects

For banks, transparency sets the tone

New research presented in a European Central Bank working paper shows a negative relationship between environmental disclosure and brown lending. The authors of Do Banks Practice What They Preach? Brown Lending and Environmental Disclosure in the Euro Area examine whether the level of environmental disclosure in banks’ financial reports matches less brown lending portfolios. From the abstract: “Using granular credit register data and detailed information on firm-level greenhouse gas emission intensities, we find a negative relationship between environmental disclosure and brown lending. However, this effect is contingent on the tone of the financial report.” Banks that express a negative tone, reflecting genuine concern and awareness of environmental risks, tend to lend less to more polluting firms, the study says. Conversely, banks that express a positive tone, indicating lower concern and awareness of environmental risks, tend to lend more to polluting firms. “These findings highlight the importance of increasing awareness of environmental risks, so that banks perceive them as a critical and urgent pressing threat, leading to a genuine commitment to act as environmentally responsible lenders.” Authors: Leonardo Gambacorta, Bank for International Settlements and Centre for Economic Policy Research; Salvatore Polizzi, University of Palermo; Alessio Reghezza, European Central Bank; and Enzo Scannella, University of Palermo.

More of the latest research:

How Does Climate Change Affect Bank Credit? A Country Level Analysis

Quantitative Modeling on the Growth and Effects of Electric Bikes in the 21st Century

Words to live by . . . .

“We cannot address the climate catastrophe without tackling its root cause: fossil fuel dependence. Leaders must act now to save humanity from the worst impacts of climate chaos and profit from the extraordinary benefits of renewable energy.” — António Guterres, secretary-general of the UN.