Green Lights May 2: Top stories this week

Don't miss a single story from the best of Callaway Climate Insights.

. . . . Welcome back to Green Lights. Here’s our roundup of the best of Callaway Climate Insights. This week, David Callaway explains why Canadian Prime Minister Mark Carney has instantly become every climate summit’s top A-lister. Plus, Michael Molinski explains why Latin American stocks, including ESG shares, are leading after the first quarter of the year. And it’s not because of politics or tariffs. Please subscribe to support our climate finance journalism.

. . . . Climate change didn’t play much of a role in Canada’s election this week. Despite living in a country ravaged by wildfires in recent years, most Canadians didn’t count fighting global warming in their top 10 most-pressing issues, almost all of which involved standing up to U.S. President Donald Trump in some way. Yet, writes David Callaway, Prime Minister Mark Carney has instantly become every climate summit’s top A-lister. How Carney is followed by other potential political leaders is one of the few reasons in this chaotic year for climate optimism going forward.

. . . . At some point, the chaotic circus around White House tariffs on U.S. imports was always going to move from an economic debate to actual pain. Investors in First Solar FSLR 0.00%↑ and a host of other stocks reached that point this week as first quarter earnings dramatically exposed the challenge that these shifting tariffs cause Wall Street.

. . . . Companies that pay up to produce and sell their products in sustainable fashion are losing out to a public perception that the climate certification means the product is more expensive, and even worse, of lesser quality, writes Mark Hulbert. Research shows that perceptions are the issue and that companies need to do more to market their products in a way that makes clear the climate badge is a plus and not a minus.

. . . . Despite trade rhetoric and climate hostility from the U.S., Latin American stocks, including ESG shares, are leading after the first quarter of the year. Michael Molinski writes that this has nothing to do with trade or politics. Rather, it’s because of an expected slowdown in the economies of the region.

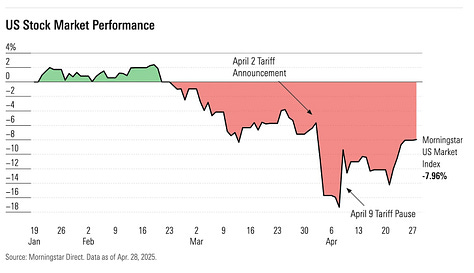

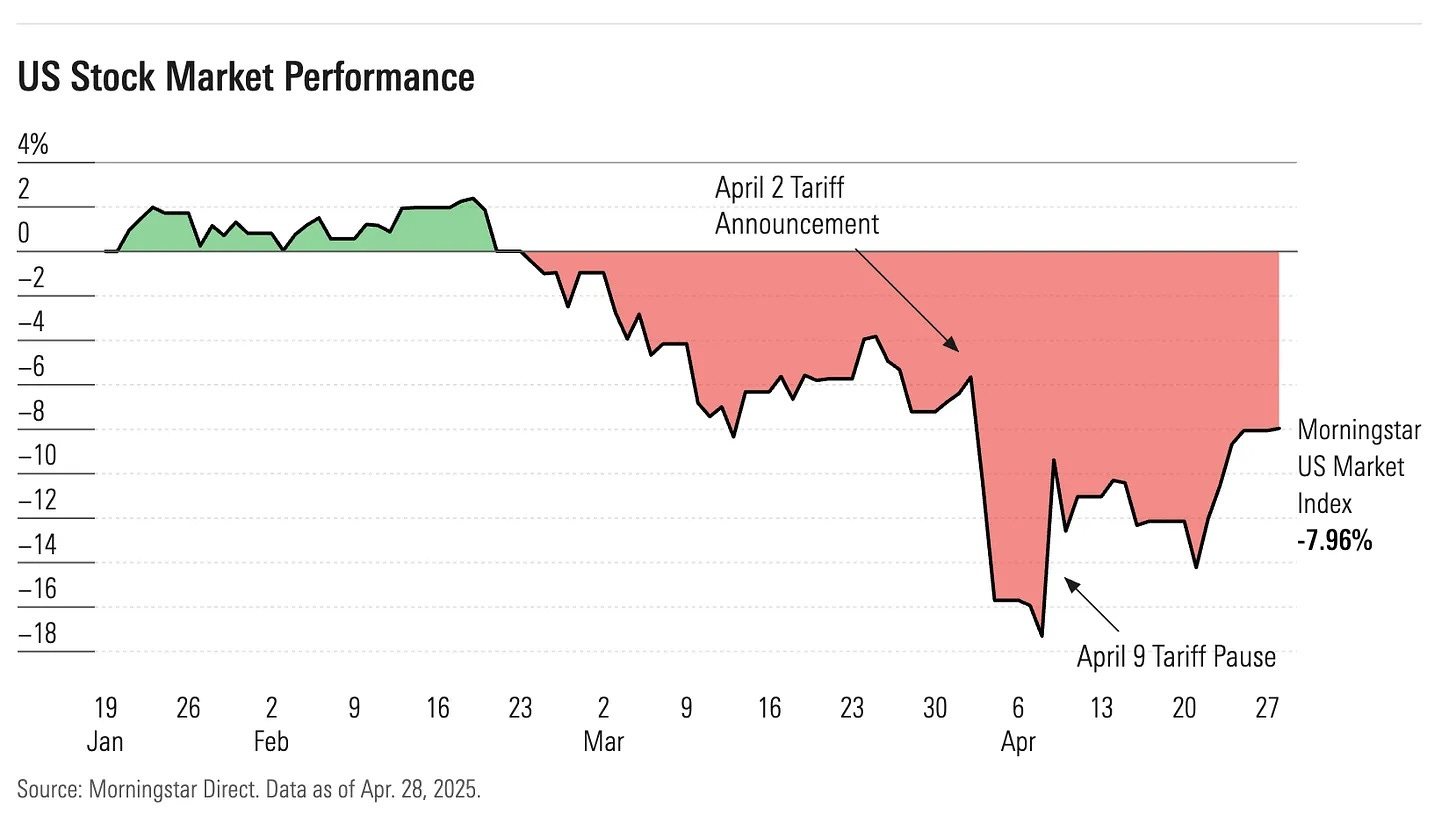

. . . . Quarterly fund figures this week showed investors in ESG and sustainable funds withdrew a record $8.6 billion in assets in the past three months, and took money out of European sustainable funds for the first time as the anti-ESG backlash in the U.S. spreads overseas. If global stock markets continue their partial recovery of the past few weeks from March’s rout, it’s likely that some bargain-hunters will be attracted to the beaten down sustainable funds. But given the ferocity of the swing last quarter, we aren’t holding our breath.

More greenery . . . .

Good news file: 5 ways we’re making progress on climate change (Vox)

No longer needed: Trump fires nearly 400 scientists working on congressionally mandated national climate report. (CBS News)

Fueling climate change: Extreme heat arrives weeks early in India and Pakistan (Environmental Health News)

Preemptive strike: Trump administration sues Hawaii, Michigan to block planned climate change lawsuits (Investing.com)

May Day: Workers unite to make big polluters pay for climate damage (Al Jazeera)