Solar stocks lead ESG performers in rocky first half for climate, markets

Welcome to Callaway Climate Insights. It's been a rough year for investors, but some environmental stocks have done better than others.

Today’s edition is free. To read our insights and support our great climate finance journalism four days a week, subscribe now for full access.

NOTE TO OUR READERS: We’re taking next week off. You should, too, if you can. Thanks.

Investors hoping to offset treacherous global warming conditions this year with opportunities in environmental, social and governance (ESG) stocks were generally left wanting in the first half. But drilling down into the sector produced some surprising names bucking the turmoil.

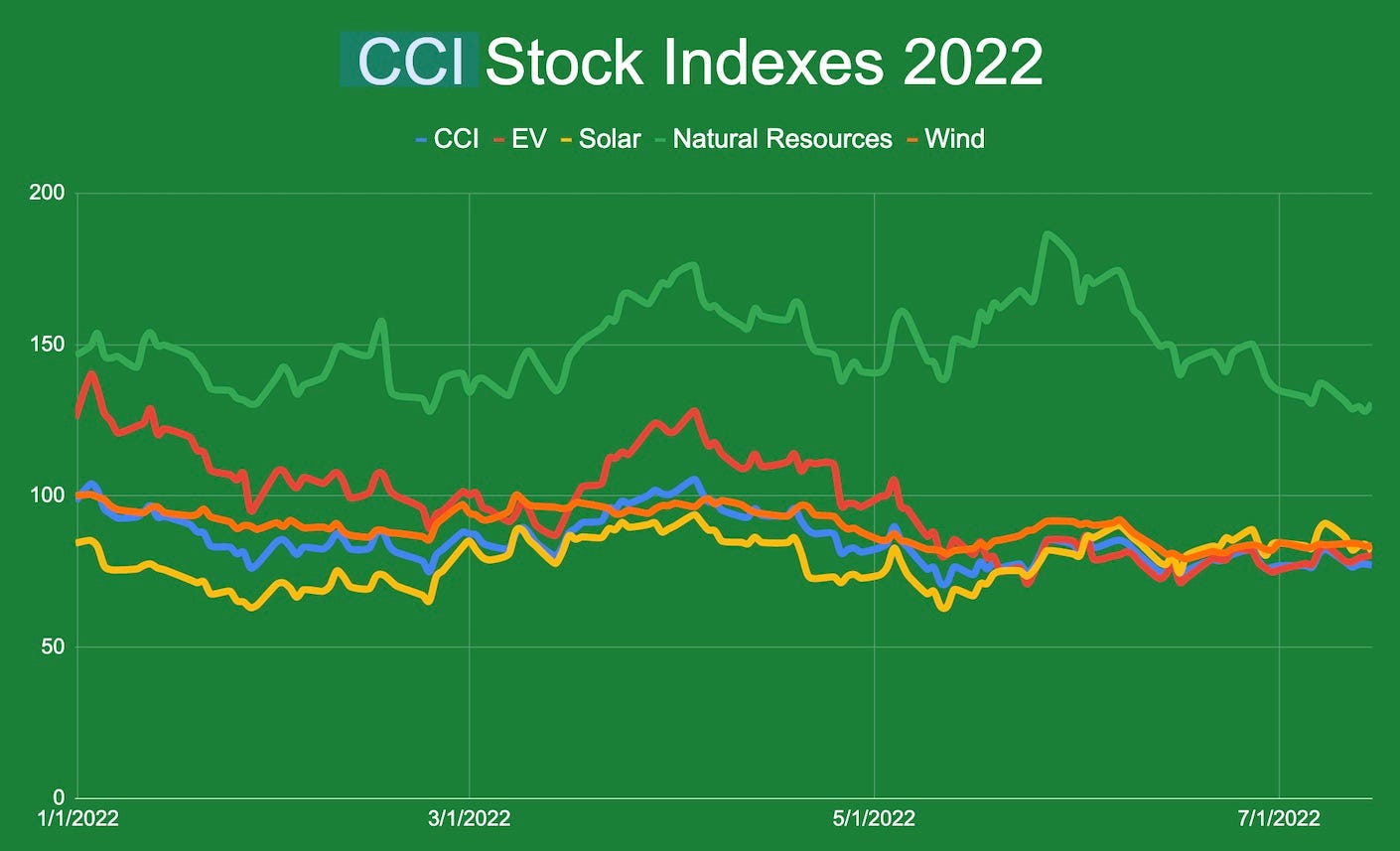

Solar stocks appear to have weathered the inflation/interest rate/Ukraine storm better than most, as well as natural resource shares. Solar shares are down only about 3% so far this year, compared to a 22% decline in the Callaway Climate Index of 50 environmental stocks and about 17% for the S&P 500.

Those include big first-half gains by JinkoSolar Holding JKS 0.00%↑, up 33%, Daqo New Energy DQ 0.00%↑, up 59%, and Enphase Energy ENPH 0.00%↑, up 17%, which we hold a small amount of. Natural resource stocks are collectively down about 11% and wind power shares have fallen about 16.5%.

Electric vehicle stocks, led lower by Tesla TSLA 0.00%↑, have performed the worst, down as much as 36% in the first half. But Tesla was up 9% Thursday after the company reported second-quarter earnings on Wednesday. Rivian RIVN 0.00%↑ shares, which debuted in November, are down almost 70%.

ESG shares have taken their lumps in the media as the bear market and lack of political climate progress sours investors on the potential for the sector, but by breaking down these results we can start to see where the recovery is going to be strongest when the bear run finally ends.

More insights below . . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

ESG fund groups lead on shareholder democracy voting changes

. . . . As research grows that greater shareholder involvement in their companies’ environmental and social efforts generates real impact, Mark Hulbert takes a look at the movement to bring direct voting to small shareholders of mutual funds and exchange-traded funds. Turns out that some of the fund companies pushing the most for more environmental action from their holdings are also the early pioneers of voting mechanisms that allow shareholders more say. . . .

A selection of this week’s subscriber-only insights

. . . . Increasingly, this appears to be electric vehicles’ moment in the U.S. Accelerated by a huge spike in gas prices, a quarter of Americans now say their next car will be an EV. The numbers make it very tempting, with some EVs now paying for themselves in about a year. The big winner: Elon Musk, whose Teslas TSLA 0.00%↑ take nearly three-quarters of the market. Read more. . . .

. . . . You might think that gas stations would be the last entity that would want anything to do with EVs. But a couple of big chains — ones that concentrate on selling things other than gas — are getting with the program by pairing with EV manufacturers to set up charging networks. Read more here. . . .

. . . . Apart from the troubled Chevy Bolt, General Motors GM 0.00%↑ has been late to the EV game. But now things are ramping up, with Tesla firmly in CEO Mary Barra’s sights. In particular, GM thinks it has a worthy rival to Tesla’s best-selling Model Y in its all-electric Chevy Blazer. With Ford also making moves — and seemingly ahead of GM — how is this all going to shake out? Read more here. . . .

. . . . The good news for the notoriously balky Texas power grid: Solar is helping keep the AC on. The bad news: Solar and wind are unpredictable and the infrastructure just isn’t there to cover the gaps in supply. What to do? Batteries and an improved distribution system. Read more. . . .

Editor’s picks: ‘We have been warned’; plus, blue hydrogen a stranded asset?

The heat is spreading

As heat waves across the globe are threatening food supplies, transportation and even lives, officials are now warning of even more heat-related dangers in the U.S. A heat wave that has baked the south-central portion of the U.S. is spreading and has more than 100 million people under heat alerts from California to the East Coast. High temps and humid conditions are forecast to grow through the weekend for many regions. “The next several days will bring extreme heat throughout the state with dangerous heat indices potentially reaching into the 100s,” New York Gov. Kathy Hochul said in a statement. “I am urging all New Yorkers to prepare for heat and humidity this week and to keep a close eye on the weather over the next couple of days. As New Yorkers, we take care of one another, so please don’t forget to check on neighbors, especially seniors, those with young children, and people with disabilities.” Hochul’s warnings were echoed by officials from Texas to Massachusetts.

Could blue hydrogen become a stranded asset?

Blue hydrogen is at risk of becoming a stranded asset as a result of policy and market forces, according to ISS ESG, Institutional Shareholder Services Inc.’s responsible investment division. Siri Hedreen writes for S&P Global Market Analysis that blue hydrogen is derived from natural gas but with carbon capture technology to offset emissions. “As such, the fuel has been favored by some natural gas companies, while others tout blue hydrogen as a lower-cost compromise between green hydrogen and gray.” While carbon capture technology has been demonstrated to capture up to 90% of carbon dioxide emissions, ISS said, “such a rate has never been achieved at commercial scale.” For that and other reasons, Hedreen writes, the ISS analysis advises investors to approach hydrogen “cautiously, and with careful consideration of the specifics of each project.”

Latest findings: New research, studies and projects

Battling time and climate change to preserve heritage sites

Climate change is destroying heritage sites around the world, and researchers say historical landmarks could disappear completely unless they are protected against environmental damage, writes Alex Whitting, in Horizon magazine via Phys.org. Whitting writes about the Hyperion EU project, which is developing tools for mapping risks and helping local authorities reduce the vulnerability of historical sites. The project aims to provide the appropriate tools in order to better understand the effects of climate change, ravages of time, intense geological phenomena and accidental, extreme weather conditions on archaeological sites and cultural heritage monuments. The report cites Angelos Amditis, Hyperion project coordinator, as saying, “If we don’t act fast, if we don't allocate the right resources and knowledge, and … create a common alliance to address the climate change issues, we will pay very dearly. … We may (completely) lose well-known landmarks in Europe and globally … our children may not have a chance to see them except on video.” The Hyperion project also uses data from Europe’s Copernicus satellites to map the areas at risk and gather climate data.

More of the latest data:

Real Effects of Carbon Emission Trading System: Evidence from Tradable Performance Standard

The Rising Tide Lifts Some Interest Rates: Climate Change, Natural Disasters, and Loan Pricing

Words to live by . . . .

“A less icy Arctic is coming, and generally speaking, that’s not a good thing. Climate change is warming this region twice as fast as the global average, threatening wildlife and indigenous communities.” — Tatiana Schlossberg.