As smoke clears in DC, a new climate agenda gathers momentum

Plus, the new A-team shaping up to fight climate on Wall Street; and how much money would get you to sacrifice your principles for profit?

A former managing editor of the New York Daily News once told me how he covered the shooting in the chamber of the House of Representatives by Puerto Rican nationalists in 1954, which wounded five Congressmen. Never had he seen such violence in the Capitol before or since. Me neither. Until yesterday.

But this morning the flag still flies. Congress is intact. And the financial markets never flinched. Despite the horrific images on our TV and phone screens, confidence in American institutions never wavered. Stocks rose yesterday and today on the real news of the week. The Democrats won the Senate and the Biden presidency is near, including his $2 trillion plan to fight climate change.

Much will be made in coming weeks of how the chaotic climax of the Trump presidency influenced the Georgia vote. And whether an essentially split Senate can deliver the promises Biden has made on climate, Covid, taxes, and everything else. Indeed, the countdown clock on what this administration can do starts on Jan. 20, but only goes for two years, until the next Congressional election.

It will take longer than that to remove the scars of the past four years. The violent protests and racism won’t go away with Trump. And early indications are the new administration will find a government apparatus hollowed out by four years of rollbacks, closed programs and unfilled jobs. A smoking battlefield of the Trump war. The Environmental Protection Agency alone is down hundreds of jobs.

As the smoke clears, the promise of what can be done will become clear. For perhaps only a brief period, the world will be cheering the new administration’s potential. The markets, at least for now, are betting on it, too. January 20 is the new New Year’s Day.

More insights below. . . .

Don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

ZEUS: Wall Street’s A-team starts to line up behind climate investing

. . . . U2’s Bono is a rock star. On Wall Street, former Treasury Secretary and Goldman Sachs honcho Hank Paulson commands a similar respect. How they came together to fight climate change underscores the rising group of financial talent being brought to bear to use investing and financial strategies to create climate solutions, writes David Callaway. From BlackRock’s Larry Fink to incoming Treasury Chief and former Fed Chief Janet Yellen, each week more of the titans of Wall Street are throwing their futures behind managing climate risk and financing ideas. In the world of ESG investing, after a record year, this suggests the beginning of something rather than the end of a rally. . . .

Hulbert: Your money or your climate?

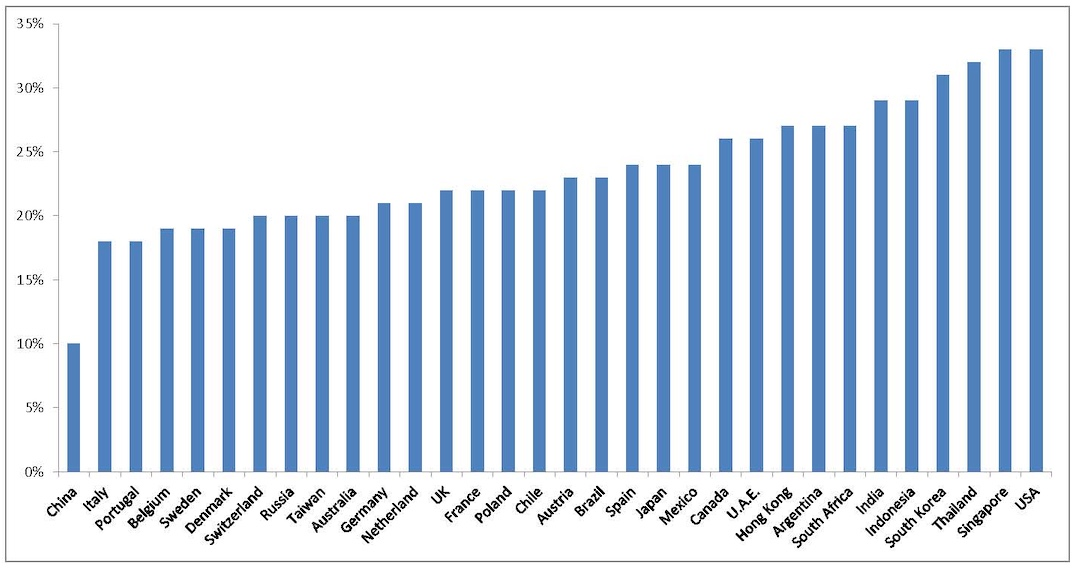

Schroders survey: Percent of investors willing to compromise their beliefs for profit, by country.

. . . . They say everybody has a price. Now Schroders Investment Management has determined which country has the most of those people. And more importantly, what that price is, writes Mark Hulbert. Depressingly, U.S. investors seem the most willing to give up their beliefs for a bit of alpha, followed by a group of Asian investors. The results have several implications, but Hulbert says an important one is what this will mean for ESG fund and stocks once their stunning rally of the past 12 months starts to fade. At that point, when the hot money flees, we’ll know who is there to fight climate change and who is not.

It’s hard to know which of these results is more depressing: That so many investors are willing to compromise their principles, or how low their price is. Regardless, this survey shows us the challenges that ESG investment managers face in making climate-friendly investments attractive to clients. . . .

. . . . The Trump Administration’s auction of drilling leases for the Arctic National Wildlife Refuge took place Wednesday, and — as widely predicted — was a dud. Only $14.4 million was raised, compared to an initial prediction years ago of up to $900 million. The state was the backstop buyer of most of the leases, which made up about half the acreage offered. Knik Arm Services, an Alaska-based real estate and leasing firm, and Regenerate Alaska, a unit of an Australian energy company, bought a few. Major oil companies shunned it. Aside from the publicity and legal concerns, the potential oil in the ground just isn’t worth it anymore . . . .

. . . . One of the sacred cows of European central banks has always been the precept of “market neutrality,” in which banks would buy bonds from companies and countries in proportion to their weight in the overall market. This was to avoid favoritism in buying bonds from some places over others in a united union. Now a group of economists surveyed by the Financial Times predicts European Central Bank Commissioner Christine Lagarde will break that tradition by cutting the ECB’s purchases of bonds of fossil fuel companies and other high-carbon emitters. The reset, if it occurs, would create dramatic precedent in fixed-income markets and a potentially volatile shift of capital from the fossil fuel sector. It would also leave the ECB open to charges of market manipulation. Of course, central banks do nothing fast, so expect a lot more arguing about this before anything happens, if at all. And with all things markets, it’s likely the cost of borrowing for fossil fuel companies will correct the bond mix itself without any artificial help from central banks. . . .

Save the date: Callaway Climate Insights and Frans Timmermans

. . . . In an exclusive for Callaway Climate Insights subscribers, European Union Climate Commissioner Frans Timmermans will join us for a webinar later this month to discuss Europe’s energy transition goals for 2030 and how it is working with the incoming Biden Administration on the climate emergency. Timmermans is one of the most influential climate leaders on the globe — a straight talker who will share his insights on transatlantic deals, how corporations can respond to the climate crisis, and public-private partnerships. The webinar on Jan. 21 will also feature a Q&A session for subscribers to ask their own questions. Read more. . . .

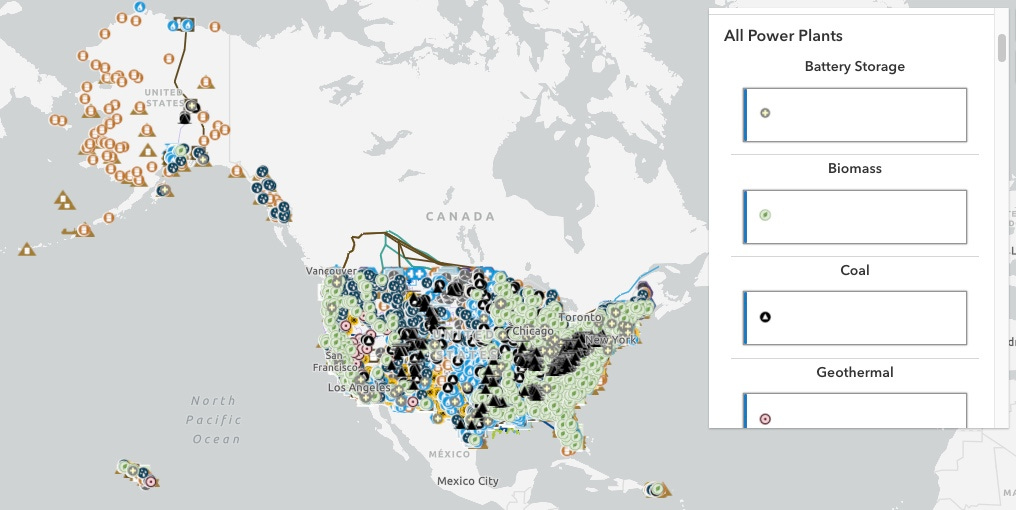

Data driven: EIA releases new U.S. energy atlas

. . . . The U.S. Energy Information Administration has posted a set of detailed, interactive maps and data that allow users to explore where different types of energy resources are produced and used. The EIA says it’s heartening to see that wind and solar are both in wide use across the U.S. . . .

News briefs: EVs shine on recovery and climate plans

Editor’s picks:

Fueling consumer interest in EVs, from Norway to Massachusetts

New Congress members include climate defenders

Wind-turbine makers see hope in 2021

Latest findings: New research, studies and projects

Interactions between climate change and financial markets

From the introduction and abstract: Climate change is one of the defining challenges of our time, with the potential to impact the health and well-being of nearly every person on the planet. In addition, climate change poses a large aggregate risk to the economy and the financial system. The tools of financial economics, designed for valuing and managing risky future outcomes, can therefore help society assess and respond to climate change risk. The authors review the literature studying interactions between climate change and financial markets. They first discuss various approaches to incorporating climate risk in macro-finance models, then review the empirical literature that explores the pricing of climate risks across a large number of asset classes including real estate, equities, and fixed income securities. In this context, they discuss how investors can use these assets to construct portfolios that hedge against climate risk, and conclude by proposing several promising directions for future research in climate finance. Available at SSRN.

More of the latest research:

Grasslands may soon produce more greenhouse gases than they sequester

Photo: Michelle Fleming/flickr.

Words to live by:

“Now is the winter of our discontent …” — William Shakespeare, from Richard III.