JP Morgan's Paris cocktail, the greening of Exxon, and closing time in Brussels

Welcome to Callaway Climate Insights, and especially to our new subscribers. Please enjoy and share, and if this was forwarded to you, please subscribe.

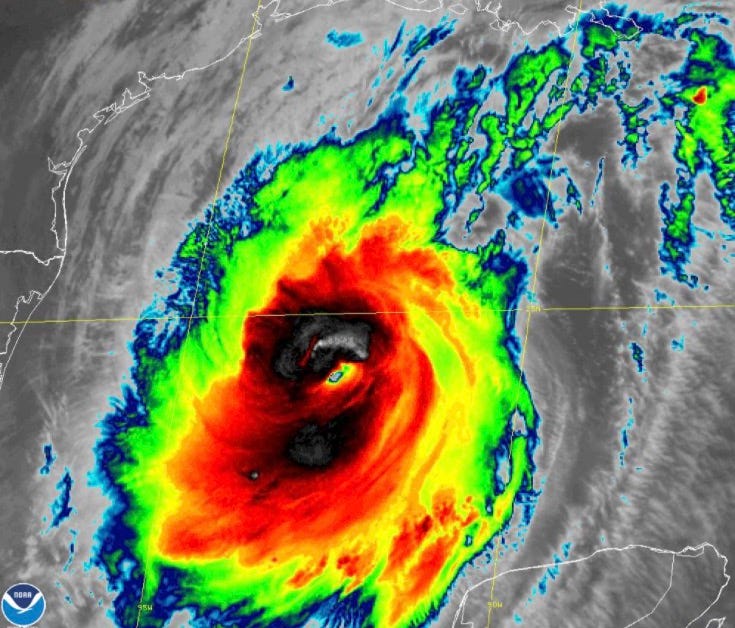

Above, satellite imagery of Hurricane Delta on Thursday. Currently a Category 2 storm, Delta is forecast to strengthen today and hit the U.S. Gulf coast Friday evening. Vice President Mike Pence and Sen. Kamala Harris, Democratic vice presidential nominee, dueled over hurricanes and other climate issues in their debate Wednesday night. See video below.

As editor of USA Today several years ago, I was lucky enough to sit down several times with Janet Yellen when she was chair of the Federal Reserve Board. Her tiny stature and friendly smile belied a rolling Brooklyn accent and a firm grip on the economic data that helped her stride over the world’s financial centers.

So when Yellen extended her considerable shadow this week to the economic case for reaching net-zero emissions, I took notice. Speaking with former Bank of England Gov. Mark Carney, with whom she co-chairs the G30 Working Group on Climate Change and Finance, Yellen made the case for carbon tax that started at about $40 per metric ton of emissions, and increased over time to “incentivize” companies to work toward the shift. Portions of the proceeds would be distributed to families and communities most harmed by climate change, i.e. minorities and the poor.

The group published a report that estimated the world’s GDP, pegged by the World Bank at $80 trillion in 2017, could fall 25% by 2100 if steps weren’t taken by governments, businesses and large investors to quicken the transition from fossil fuels. Recommendations also included stress tests on financial institutions in the next two years and mandated disclosures of risks and opportunities in three years.

As I’ve said before, one of the best ways to get the world’s largest financial institutions to start moving toward re-modeling their portfolios is for the central banks to push them. A tax is one way to price carbon and while a market price might be better, the tax plan with dividends for communities is more politically attractive.

Carney and Yellen may not hold the levers of power they once did in their central banker’s seats, but they still cast long shadows when it counts. Look for a carbon tax to take center stage in a Joe Biden climate plan if he wins the election next month.

More insights below. . . .

And don’t forget to contact me directly if you have suggestions or ideas at dcallaway@callawayclimateinsights.com.

An Exxon Mobil green bond? Don’t laugh

. . . . Climate change investors this week could be forgiven for being “shocked, shocked!” by private documents, which revealed that Exxon Mobil’s seven-year strategy before the pandemic hit would have resulted in a 17% rise in greenhouse gas emissions. That’s what oil companies do, right? But Mark Hulbert posits that the bigger the polluter, the bigger the opportunity for investors who might offer the right, uh, incentives, such as creative financing for troubled energy companies.

To be sure, it’s impossible to know for sure whether Exxon Mobil can be pushed. But we do know that it’s worth the effort. The company is one of the biggest global emitters of greenhouse gases, either directly through its own operations or indirectly from those who burn the fuel the company sells. An even modest reduction in the company’s total could very well benefit the climate more than most other actions you can take as investors.

And we also know what isn’t working: The dual strategy of divestment coupled with suing them. To even consider the possibility of changing ExxonMobil’s behavior through our investments, we have to be willing to overcome our preference for investment purity and instead invest in a company that many environmentalists consider to be the financial equivalent of Voldemort. . . .

ZEUS: JP Morgan’s Paris cocktail, with an olive

. . . . One of my favorite Winston Churchill martini stories is that rather than add Vermouth, he’d simply raise his glass and simply toast in the direction of France, where much of it is made. JP Morgan Chase’s (JPM) awkward tilt toward the Paris Climate Agreement this week reminded me of just such an empty and somewhat cheeky gesture, promising to someday move its clients to carbon neutral without actually adding the splash of real action.

JP Morgan is one of the biggest lenders — along with Citibank (C) and Bank of America (BAC) — to energy companies and utilities, with $43 billion and $32 billion in financing commitments, respectively, to each, according to S&P Global Markets. Nobody expects the bank to realistically pull out of those deals overnight. But acknowledging that it will need to move in that direction is at least a first step.

The reality is that the markets will move faster than any climate pledges could possibly achieve, making lending to fossil fuel companies quickly less attractive than other industries, such as the renewable energy. As companies in the green sector become more competitive and their prospects grow, their ability to create profits for their financial backers will lure reluctant banks to the hotter money. . . .

European Notebook: Covid, climate and closing bars in Brussels

. . . . The bars in Brussels closed again this week, as the second wave of Covid-19 hits Europe hard, but not before a key vote on new emissions-slashing strategies was given a green light, writes Stephen Rae from Dublin. Just time for one or two celebratory sour beers before a more important test on whether the strategy at the heart of the continent’s Covid-recovery plan can become reality.

At least they have something to celebrate. All the action was in the European Parliament on Wednesday where MEPs finally voted on Ursula von der Leyen’s climate law. And it was a win for a coalition of Green, left-wing and assorted center parties who voted in favor of a 60% greenhouse gas emissions cut by 2030. The majority of MEPs rallied around the 60% goal championed by Pascal Canfin’s influential environment committee (as reported by CCI last month).

This week’s victory comes just a week before EU leaders are due to have a first discussion of the climate target and ahead of an Environment Council on Oct. 23, when the climate law is on the agenda. The ones to watch are Poland and the Czech Republic. . . .

Start-up alert: Battery power through radioactive waste

. . . . A new company called Infinite Power goes live in the UK next week with a unique take on renewable energy: making it from radioactive waste. The process, developed over eight years by scientists in Australia and the UK, creates energy from radioisotopes, in a process similar to how solar cells capture the sun’s energy. Serial entrepreneur Robert McLeod, a longtime friend, was brought in as CEO recently to help make the process commercial. It includes building boxes, or bricks of the power cells like Legos, above, to make up small and large power stations throughout the country. . . .

Infinite said it will be initially focused on the UK market, which British Prime Minister Boris Johnson promised just this week will seek its future in offshore wind energy. Johnson said wind from the seas around the British Isles will power all British homes by 2030.

“It’s a very brave call by Johnson to say he wants to power all homes by wind, but if you want to do that, you’d need a wind farm the size of Wales,” said McLeod. “We can provide a base load power supply to support wind and solar energy, much like coal power does now.”. . .

Data driven: Steamy September

Above, a solar eruption captured by NASA’s Solar Dynamics Observatory.

. . . . September was the warmest on record globally, according to the Copernicus Atmosphere Monitoring Service. It was 0.05°C. hotter than September last year, which in turn set the previous record high for the month, the BBC reports. Copernicus, which is the European Union's Earth observation program, said warmth in the Siberian Arctic continues way above average. And it confirmed that Arctic sea ice is at its second lowest extent since satellite records began, the BBC said. . . .

News briefs: $5 trillion bill for climate change, Pence and Harris spar

. . . . Watch this: In the first and only vice presidential debate between Sen. Kamala Harris and Vice President Mike Pence, the two addressed whether they believe climate change poses an existential threat and clashed over fracking. . . .

Editor’s picks:

Without emissions cut, costs could reach $5 trillion per year

Clean energy jobs see slow recovery during pandemic

California sets land conservation and carbon goals

Latest findings: New research, studies and projects

Above, an abandoned asbestos mine. Photo: Kerbla Edzerdla/Wikipedia.

Asbestos could help fight climate change

Researchers are digging out samples from an asbestos mine that’s been shuttered since 1980, trying to determine the makeup and structure of the materials pulled from the pits, and to answer two critical questions: How much carbon dioxide do they contain; and how much more could they store? James Temple writes in the MIT Technology Review this week about how asbestos could be a powerful weapon against climate change through carbon sequestration. According to the report, Caleb Woodall, a graduate student at Worcester Polytechnic Institute in Massachusetts, and his adviser Jennifer Wilcox, a carbon removal researcher, are among a growing number of scientists exploring ways to accelerate these otherwise slow reactions in hopes of using mining waste to fight climate change. It’s a handy carbon-capturing trick that may also work with the calcium- and magnesium-rich by-products of nickel, copper, diamond, and platinum mining, Temple writes.

More research:

Words to live by . . . .

“As Saudi Arabia is to oil, the UK is to wind — a place of almost limitless resource, but in the case of wind, without the carbon emissions and without the damage to the environment.” — UK Prime Minister Boris Johnson, speaking this week at the Conservative party conference.