Wind stocks leap, tigers in the stream; and the great climate risk re-pricing is here

Welcome to Callaway Climate Insights, and especially to our new subscribers. Please share with your networks and if this was forwarded to you, please sign up.

The climate space is not wanting for dire predictions of collapse and calamity, and no Covid-19 surge or summer doldrums will hold back the steady drumbeat of alarming data for those who seek it. But tigers?

As the East Coast and parts of Europe bake, a massive study that came out this week narrowed the range of expectations for how hot it will get in the future, but importantly raised the lower limit of the likely warming range to 2.6°C., which itself is well beyond targets and portends disaster.

Closer to home here in California, a UCLA research team published a new study with expectations that higher temperatures will lead to severe changes in the “atmospheric rivers” that carry moisture around the globe, resulting in 40% more rain, hail and snow in the Sierra Nevada range. Good for skiing, bad for flooding.

We take these predictions with enough skeptical salt to down a tequila shot, but even we sat up at the letter major pension funds and fund managers sent this week warning the Federal Reserve and Securities and Exchange Commission of a “systemic threat” to the U.S. financial markets of climate change unless they act to address it across all of their mandates. The letter, predicting “significant disruptive consequences on asset valuations” from storms and heat and their impact on loans and other assets, underscores that Wall Street is ahead of Washington again on hedging for what’s next.

For our part, as illustrated in the NASA image above of destructive flooding this season in China, it’s not what’s coming but what’s already here that threatens economies and markets. A global re-pricing of risk is not a threat. It is upon us.

More insights, including the tigers, below:

Above: Sediment from torrential rains in southeast China flows into the ocean near Hong Kong. (Image credit: NASA Worldview).

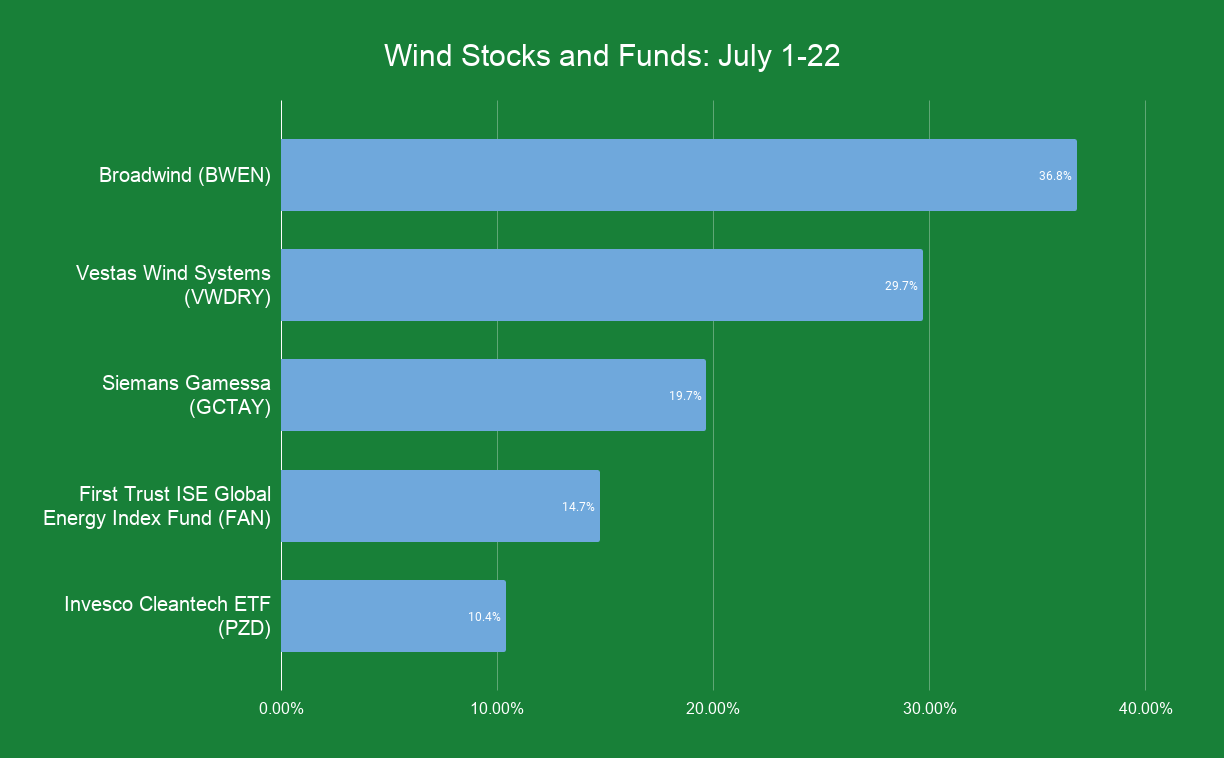

ZEUS: The wind behind renewable energy stocks

. . . . While Congress bickers over adding renewable energy investment to its massive infrastructure plans post-Covid-19, wind energy stocks have been quietly rallying this month as orders rebounded from the pandemic spring and investors looked to a rebuilding possibility not stymied by politics, writes David Callaway.

While the solar industry is often viewed as sexier than wind power, wind energy is picking up both onshore and offshore. Most of the offshore projects are in Europe and Asia, mostly China. In the U.S., there is only one online, although the Vineyard Wind project off of Massachusetts is making progress.

There are more than 50,000 wind turbines onshore, however, in the U.S., in states like Texas, Oklahoma, the Dakotas and many others. Together they employ more than 100,000 people, though supply chain disruptions tied to the pandemic have hit wind energy just as hard as other renewables. Estimates are more than 600,000 renewable jobs have been lost this past spring. . . .

Add Bengal tigers to your list of climate threats to humans

. . . . They had me with the waist-high water and people sleeping on rooftops. But animators Upamanyu Bhattacharyya and Kalp Sanghvi of Ghost Animation in India made the climate-changed world of the future even scarier.

We often don’t think of the impact of climate change on animals, besides koalas killed in Australia’s wildfires. But the forced migration of much of the human race that is predicted as more of the world becomes uninhabitable will also impact animals, including dangerous ones.

Question: Describe how you chose to combine the impact of the rising waters on animals (tigers) as well as humans. That is an angle of the climate threat which I don't think is explored enough.

Answer: Once the sea level rises, it will affect forests, cities, humans and animals alike. Everyone will suffer. The Sundarbans delta, just south of the city of Kolkata, is extremely rich and diverse in wildlife. The delta has already begun to flood. Once it is submerged, the animals and humans who have managed to survive will claw their way north toward drier lands in search of shelter and food. This is something that caught our attention. The residents of the Sundarbans delta would practically move to the city. The royal bengal tigers, being a huge part of the ecosystem, will too. This is what we tapped into and built our universe around. . . .

BMW’s battery deal with Sweden’s Northvolt boosts European EV race

. . . . BMW’s deal with Sweden’s Northvolt to for batteries for electric vehicles, estimated by the company at about €2 billion ($2.3 billion), is the latest in the race among Europe’s largest automakers to capture the emerging EV market, writes Elizabeth Hearst from Dublin. Stronger auto emissions requirements make Europe a natural battleground for EVs, compared to the U.S.

The cost of the project represents the drive for electrification of the BMW fleet with the group currently representing just 4% of total electric vehicle output worldwide, something that BMW executives want to increase. The market leader in electric vehicles is Elon Musk’s Tesla (TSLA), which accounts for a massive 21% of total global electric vehicles. Yet European buyers remain faithful to the German conglomerate, with BMW, Volkswagen (VLKAF) and Tesla all sharing the spoils on 10% of the total European market share each.

Your move, Elon Musk. . . .

Dutch group seeks end of biomass for renewable use

. . . . Biomass, the organic material such as wood and crops used as an energy source, is increasingly on the outs in Europe, which favors moving to green hydrogen. Last week, scientists admitted not all biomass was carbon-friendly, and in the past few days, a Dutch economic group warned The Netherlands to stop using it all together. . . .

Data driven: Sun exposure

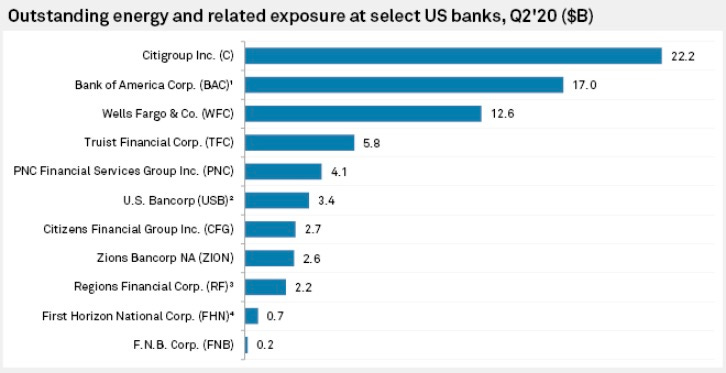

U.S. banks reduced energy exposure in the second quarter, Lauren Sullivan and Robert Clark write this week in S&P Global Market Intelligence: “Amid a tumultuous quarter for the energy sector, including a collapse of oil prices in April that briefly pushed futures into negative territory, most U.S. banks reported linked-quarter declines in their energy loan concentration metrics.”

(Chart: S&P Global)

News briefs: Methane leaks, and a ‘systemic threat’ to the economy

Watch this: Climate change catastrophe: What does melting permafrost mean for our planet?

Editor’s picks:

First active leak of sea-bed methane discovered in Antarctica

Investors, pension funds: Climate change a ‘systemic threat’ to economy

China’s coronavirus recovery drives boom in coal plants

Latest findings: New research, studies and papers

How hot is it going to get?

In what is being called a landmark effort, a team of 25 scientists has significantly narrowed the bounds on climate sensitivity, that is, the temperature range addressing how hot the Earth will get, Paul Voosen writes in Science magazine. The assessment, conducted under the World Climate Research Programme (WCRP) and publishing this week in Reviews of Geophysics, looks at trends indicated by contemporary warming, the latest understanding of the feedback effects that can slow or accelerate climate change, and lessons from ancient climates. They support a likely warming range of between 2.6°C. and 3.9°C., says Steven Sherwood, one of the study’s lead authors and a climate scientist at the University of New South Wales.

Climate risks and the cost of sovereign borrowing

The authors empirically examine the link between the cost of sovereign borrowing and climate risk for 40 advanced and emerging economies. Controlling for a large set of domestic and global factors, they show that both vulnerability and resilience to climate risk are important factors driving the cost of sovereign borrowing at the global level. Overall, they find that vulnerability to the direct effects of climate change matter substantially more than climate risk resilience in terms of the implications for sovereign borrowing costs. Moreover, the magnitude of the effect on bond yields is progressively higher for countries deemed highly vulnerable to climate change.

Authors: John Beirne, Asian Development Bank Institute; Nuobu Renzhi, Asian Development Bank Institute; Ulrich Volz, University of London, School of Oriental and African Studies

ADBI working paper 1160, available at SSRN

Aerosols affect solar power yield in Europe

Yield forecasts of photovoltaic systems are based on the predictions of solar irradiance. Extensive forest fires or the episodic transport of Sahara dust to Europe can, however, lead to clearly false predictions of solar irradiance on individual days. Phys.org reports on the PermaStrom research project, a joint research team from Karlsruhe Institute of Technology, German Weather Service, and Meteocontrol, a solar energy service provider, is investigating how to better account for such events in weather forecasts. The insights gained from the project should help make more precise yield forecasts for photovoltaic systems. The German Federal Ministry for Economic Affairs and Energy funds this project with € 2.5 million.

Words to live by. . . .

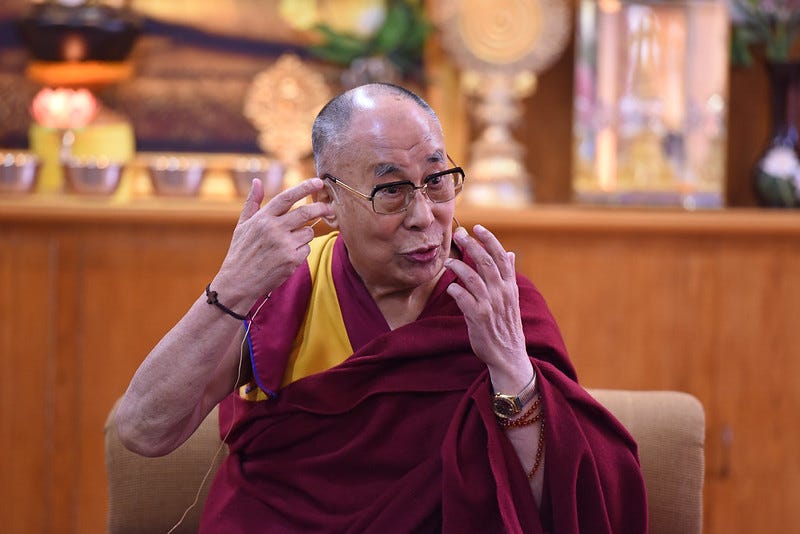

“Climate change is not the concern of just one or two nations. It is an issue that affects the whole of humanity and every living being on this earth.” — Dalai Lama

Photo: U.S. Institute of Peace/flickr.

Questions or comments? Please email me directly at: dcallaway@callawayclimateinsights.com.