Escape from Mar-a-Lago, and why water stocks are the next gold

Welcome to Callaway Climate Insights, and especially new subscribers. Please pass this along to your colleagues and if it was forwarded, please sign up.

By 2050, President Trump’s Mar-a-Lago Florida resort is projected to be under at least a foot of water 210 days every year.

Thousands of years from now, when the waters finally recede, will our descendants look upon the miraculously preserved remains of Mar-a-Lago as we look at Stonehenge today? Do you think they’ll wonder what the people who built it were thinking, or who lived there? Nah, me neither.

But Mark Hulbert’s expert analysis of the insurance industry’s challenges as major parts of the Florida coast become submerged drives home a watery future for President Trump’s, uh, future home. And also in our showcase this week, Scientific American unveils a major discovery on where the stones from Stonehenge actually came from. I won’t ruin the surprise, except to say that my bet on aliens is looking more like a long shot.

These edifices, like so many others well-known today, are destined to be ruins themselves, if many climate predictions prove true. Some sooner than later. But with water rising everywhere, it’s hard to imagine we’ll soon face severe water shortages in many parts of the world, including the southwestern U.S. Investors marveling this week at how gold has performed during the pandemic this summer might take a moment to look to the universe of water stocks for inspiration on the next overlooked commodity.

More on water stocks in my ZEUS column, as well as the latest from Europe, and the renewables opportunity in Latin America.

Enjoy.

ZEUS: Finding sunken treasure in water stocks

. . . . It took a worldwide pandemic to push gold futures above $2,000 an ounce this week, but for gold bugs it’s been a long time coming. My former MarketWatch colleague Thom Calandra (The Calandra Report) once painted his hair yellow when gold hit $300. What will he do for an encore?

Water stocks are starting to develop that overlooked commodity feel as well, especially as scarcity reports in the U.S. Southwest and other parts of the world begin to attract attention. And infrastructure delays tied to Covid-19 pressure utilities. Some of the bigger water companies and ETFs have leaped in price this summer as investors start to see a long-term play.

The Invesco Water Resources ETF (PHO) is up more than 20% since mid-March, as is the First Trust Water ETF (FIW). American Water Works (AWK) shares are up more than 10%, as are shares of Essential Utilities Inc. (WTGR). Shares of Evoqua Water Technologies are up more than 30% . . . .

Hurricane risk poses a modeling challenge for insurers, though one thing’s for certain

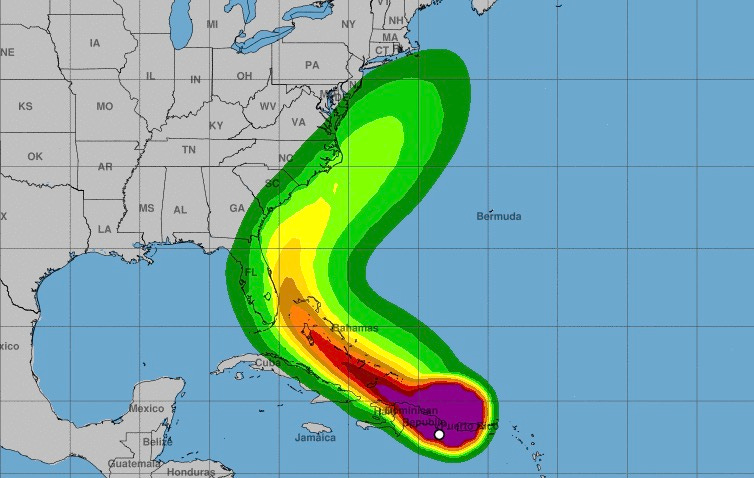

Above, tropical-storm-force wind speed probabilities for TS Isaias as of Thursday morning. Image: NWS.

. . . . Wake news?: President Trump’s Mar-a-Lago resort in Palm Beach faces the same sort of risk from rising sea-levels most of coastal Florida does. Would anyone be bold enough to insure it? Mark Hulbert writes that insurance companies facing bigger, badder hurricanes and flooding might actually help the world fight climate change if sky-high premiums on waterfront properties convince people to move to higher ground.

Because of difficulty with hurricane data, Hulbert argues the potential for water destruction is not accurately priced in yet, if it ever will be. But the private market might lead some insurers to vote with their feet.

To get a sense of the magnitude of this uncertainty, consider hurricane risk — perhaps the biggest of the weather-related disasters that insurance companies currently insure against. According to reinsurance company Swiss Re, total U.S. hurricane losses over the past five calendar years (through 2019) amounted to close to $300 billion, or an average of around $60 billion per year. Over the first five years of the 1980s, in contrast, the comparable total (in 2019 dollars) was less than $25 billion, or about $5 billion per year. . . .

Clean energy searches for capital in Latin America

. . . . Latin America boasts twice the global average of renewable energy usage than the rest of the world, but it is lacking for investors, writes Michael Molinski. Sharp gains in wind and solar projects are adding competition to the traditional hydro-powered assets in the past few years. But most are either government-owned or in private hands. Roadblocks that prohibit small companies from placing shares on local exchanges, or linking to global exchanges, need to be removed to help attract capital. . . .

Midnight train to … Hamburg?

. . . . Night moves: Sweden, home of flight-shaming, laid out plans for more overnight trains this week as Europe rushes to find ways to reduce short-haul air travel as part of its green economic recovery, writes Elizabeth Hearst.

National rail transport makes up over 70% of total transport in the European Union, with statistics showing that rail transport usage is increasing. In 2017, the EU recorded over 1 billion passengers who traveled by air for the first time, and campaigners are keen to reduce this number and its climate impact by reverting back to trains. . . .

LanzaTech’s bet to clean up aviation

. . . . Covid-19 has hurt the airline industry’s efforts to experiment with sustainable aviation fuels, but this Chicago company is optimistic there will be a growing market for SAFs in the next decade, writes Molly Glick. LanzaTech has recently signed funding deals with Canadian and Japanese investors and spun out a separate SAF business, LanzaJet, said CEO Jennifer Holmgren, in an interview.

These fuels have the potential to reduce the U.S. aviation sector’s greenhouse emissions by up to 90% compared to 2005 levels, according to an October 2019 study published in Transportation Research. SAFs could therefore help the global industry meet its lofty goal to halve emissions by 2050, as proposed by the International Air Transport Association (IATA). In 2018, commercial aviation contributed about 2.4% of global carbon dioxide emissions, which had steadily increased over the previous five years.

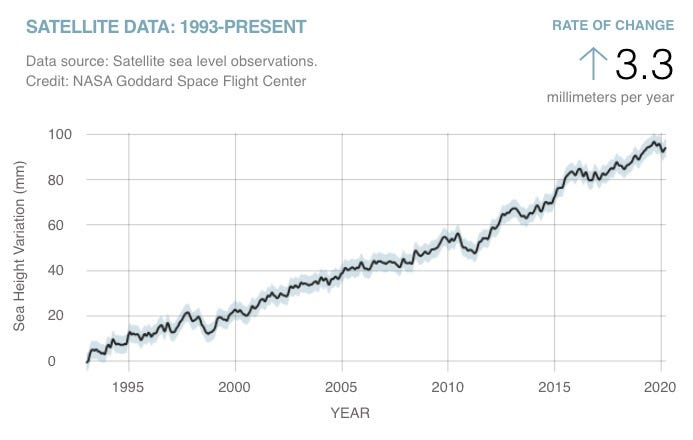

Data driven: Water, water, everywhere

Sea level: 94 (± 4) mm

Sea level rise is caused primarily by two factors related to global warming: the added water from melting ice sheets and glaciers and the expansion of seawater as it warms. The above graph tracks the change in sea level since 1993 as observed by satellites.

Source: NASA. Latest measurement: March 2020.

News briefs: Stonehenge mystery solved; short-selling ESG

Researchers have solved the mystery of the origin of the 25-ton sarsens of Stonehenge. They come from the ancient woodlands of Wiltshire, about 16 miles north of the prehistoric site. Read more about the findings in Scientific American.

Editor’s picks:

Can short-selling protect investors from ESG risks?

MacKenzie Scott (Bezos) donates to environmental fight

Forests migrate, but they can’t outrun climate change

Latest findings: New research, studies and papers

Natural disasters, climate change, and sovereign risk

The author investigates how natural disasters can exacerbate fiscal vulnerabilities and trigger sovereign defaults. He extends a standard sovereign default model to include disaster risk and calibrate it to a sample of seven Caribbean countries that are frequently hit by hurricanes. He finds that hurricane risk reduces a government's ability to issue debt and that climate change may further restrict market access. Next, he shows that disaster clauses, which provide debt-servicing relief, improve government ability to borrow and mitigate the adverse impact of climate change on government's borrowing conditions.

Author: Enrico Mallucci, board of governors of the Federal Reserve System

In FRB International Finance discussion paper No. 1291, via SSRN.

Impacts of Covid-19 on a transitioning energy system

Short-term outcomes of the Covid-19 pandemic have included improved air quality and reduced CO₂ and other greenhouse gas emissions, while long-term repercussions may include a disruption to joint international research efforts, the creation of silos, and the potential for internalizing efforts toward national rather than global goals. In this study, the authors identify the impacts of reduced mobility on pollutants and emissions, the emergence of nationalist approaches and effects on international cooperation, and how these issues will affect the achievement of global carbon targets and the Sustainable Development Goals (SDGs).

Authors: Andrew Chapman, Kyushu University; Takeshi Tsuji, Kyushu University

Available from SSRN.

Catalyzing capital for the transition to decarbonization: blended finance

Climate finance is at the center of discussions about how the international community can shift to low-emission, climate-resilient development pathways. The world needs to invest trillions of dollars annually in order to keep warming within 1.5°C. Current global climate finance flows, however, are vastly inadequate. The demand for additional capital is particularly acute in developing countries, where choices to be made over the next decade will play a major role in determining the future course of the global climate system. Blended finance, a structuring mechanism with potential to mobilize significant capital and investment from diverse actors, has emerged as one promising solution to help economies decarbonize and deliver the goals of the Paris Agreement.

Authors: Esther Choi, Stanford Sustainable Finance Initiative; Alicia Seiger, Stanford University Steyer-Taylor Center for Energy Policy and Finance; Stanford Sustainable Finance Initiative

Available at SSRN.

Above, Texas National Guard soldiers help Houston residents during Hurricane Harvey. Photo: Texas Military Dept.

Words to live by . . . .

“I know the impact that carbon pollution is having in our oceans with acidification and coral bleaching. If we stay on the course that we are on, or only mildly modify it, we are going to lose all of our coral, probably by the middle of the century and certainly by the end of the century.” — James Cameron