5 biggest tech polluters, U.S. falls in green rankings, and climate's inequality problem

Welcome to Callaway Climate Insights, and a rousing hello to our new subscribers this week. We hope you enjoy our coverage. If so, please share and spread the word.

Black lives matter. Black journalists’ lives matter. Journalists’ lives matter.

The inequality and institutional racism that leaks into every aspect of American society places a greater load on blacks and other minorities during recessions and pandemics. Climate change is no different. We can’t work together to adapt to the coming changes if we aren’t together.

One of the many horrifying aspects of the protests this week and the reaction of authorities was that journalists were attacked while doing their jobs — from both sides, by cops and protesters. This is a direct result of President Trump’s war on the media and an ominous warning for the tumultuous five months leading up to Election Day. It cannot stand. Journalists are not perfect. Protesters are not perfect. Police, as we’ve seen in such awful video examples, are nowhere near perfect. America needs all three to be America.

Climate change takes a back seat in the face of immediate assaults on society, like racial conflict, viruses or authoritarianism. But it is still in the car. On this 31st anniversary of the Tiananmen Square massacre, we at Callaway Climate Insights stand with all those who want to create a better world for their children and anyone who seeks equality and fairness in any society.

The insights and analysis below are dedicated to those inspired to creating that world. Until black lives, journalists’ lives, and all lives, matter — no lives matter.

Above, protests June 3, 2020 in Columbus, Ohio. Photo: Paul Becker/Flickr (CC BY 2.0).

ZEUS: Shaky markets unprepared for climate risk

. . . . One of the more striking surprises this week as the protests raged through the U.S. was how little they affected financial markets. While some would argue there is little long-term financial impact by the shut stores and curfews, and that progress in the battle against Covid-19 was a bigger deal, it might also be that the lack of emotion in market forces leaves them ill-equipped to prepare for disasters and tragedies.

Markets move up or down — until they don’t. It’s usually triggered by an event. In the climate change space, that is a risky way to operate. Despite movement by banks and investors to develop standards to measure climate risk on markets, sectors, and even individual companies, the markets remain woefully unprepared for what’s to come. . . .

. . . . Kind of like these homeowners in Norway yesterday. Just saying.

5 biggest tech greenhouse gas emitters

. . . . The carbon offset market allows companies to purchase credits toward green projects to offset their greenhouse gas emissions. But those emissions still exist. Mark Hulbert explains why we should focus on a company’s gross emissions, and shows how those stack up in our largest tech companies, such as Amazon and Microsoft, all members of some ESG funds in one way or another . . . .

Why 'social' screening is critical in ESG

. . . . Pledges by CEOs and companies to better recognize and improve the way they handle social issues in their cultures is what puts the “S” in ESG, writes Anthony Davidow. How companies respond to events like those this week can only improve their ESG score and make them better potential investments. . . .

Denmark tops rankings in new Environmental Performance Index

. . . . Australia and Japan broke the stranglehold European countries have had in green progress in the prestigious Environmental Performance Index 2020 rankings announced today by Yale University and Columbia University, though just barely. Europe still dominated the top 10, with Denmark replacing Switzerland at the top. The U.S. ranks a dismal 24th. . . .

Linde, Air Liquide bullish on clean hydrogen

. . . . Europe’s leap into a green recovery last week focused closely on green hydrogen as the future fuel of choice for trains, trucks, buses and industrial manufacturers. This bodes well for two of the region’s top gas producers. Darrell Delamaide explains how Linde PLC and Air Liquide, the world’s two biggest producers of industrial gas, intend to use the carbon alternative to grow their businesses in coming years. . . .

Europe: Battle brewing for green airline plan

. . . . While Covid occupies the headlines, the EU makes progress on new Climate Law and prepares for battle over whether to delay green airlines scheme, in Stephen Rae’s European notebook. . . .

Climate proxies start to force corporate change

. . . . Climate change proxy measures are surging this year across the U.S., Europe and Japan, putting pressure on firms to respond to activists — despite restrictions from the Covid-19 pandemic. While few measures are gaining absolute majority shareholder support, the trend helps activists and moves companies closer to greener goals. . . .

News briefs: Swiss startup Climeworks raises $75 million

Watch this: How scientists calculate climate change | The Economist

Climate activists talk a lot about following “the science” around climate change. What actually is the science and how is it calculated?

Editor’s picks:

Swiss direct-air capture startup Climeworks raises $75 million

Russia declares emergency in Arctic after diesel leak

Candy maker Mars joins commitment to climate efforts amid pandemic

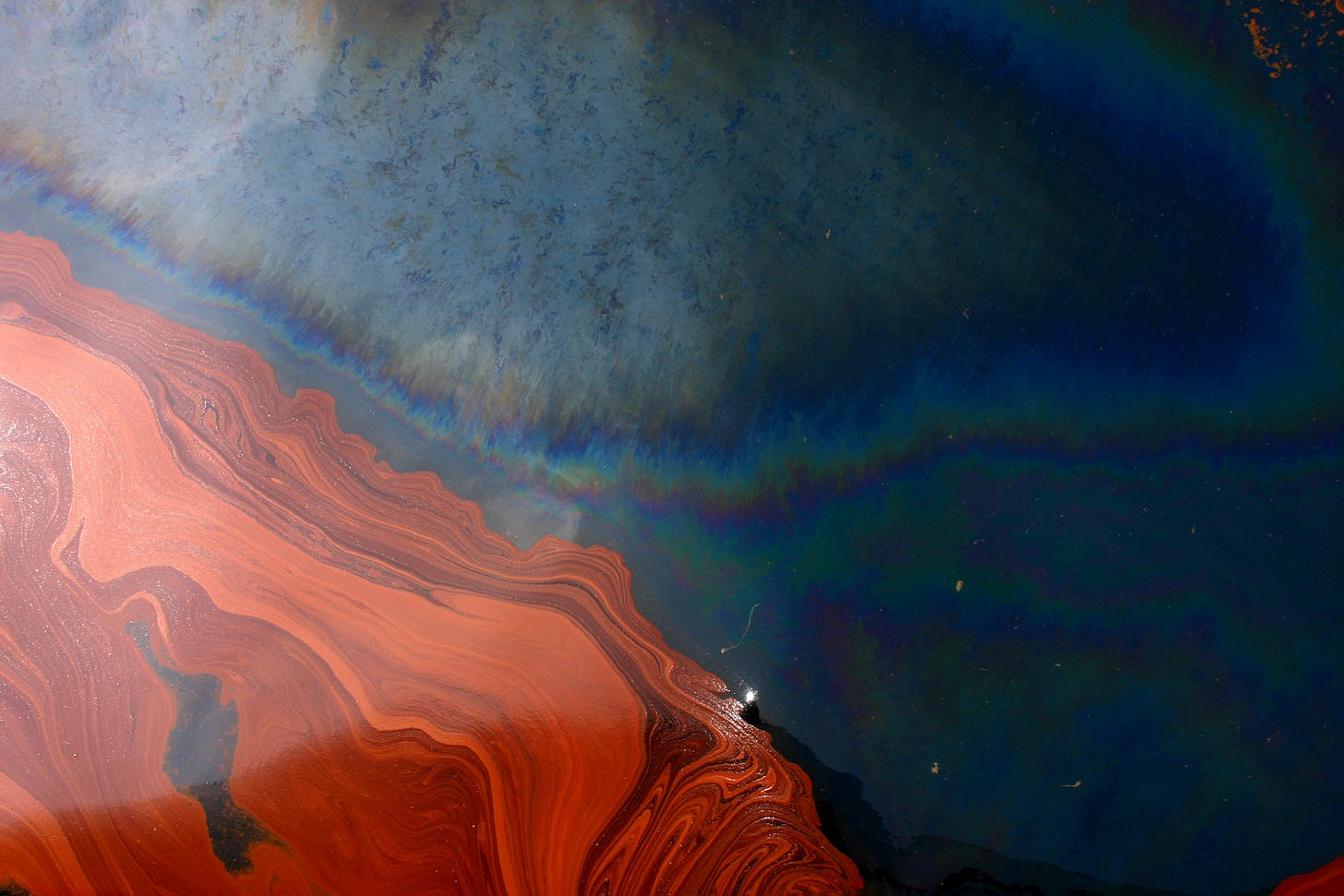

Data driven: oil’s spill

Covid-19 is causing the biggest fall in global energy investment in history, IEA says.

At the start of this year, global energy investment was on track for growth of around 2%, which would have been the largest annual rise in spending in six years, according to the International Energy Agency. But after the Covid-19 crisis brought large swathes of the world economy to a standstill in a matter of months, global investment is now expected to plummet by 20%, or almost $400 billion, compared with last year, according to the IEA’s recent World Energy Investment 2020 report.

A combination of falling demand, lower prices and a rise in cases of non-payment of bills means that energy revenues going to governments and industry are set to fall by well over $1 trillion in 2020, according to the report. Oil accounts for most of this decline as, for the first time, global consumer spending on oil is set to fall below the amount spent on electricity.

Above: weathered oil from the Deepwater Horizon oil spill Photo: David L. Valentine, University of California, Santa Barbara/NSF.

Latest findings: New research, studies and papers

Climate change and credit risk

The authors investigate the relationship between exposure to climate change and firm credit risk. They show that the distance-to-default, a widely used market-based measure of corporate default risk, is negatively associated with the amount of a firm’s carbon emissions and carbon intensity. Therefore, companies with high carbon footprint are perceived by the market as more likely to default, ceteris paribus. The carbon footprint decreases the distance-to-default following shocks — such as the Paris Agreement — that reveal policymakers’ intention to implement stricter climate policies. Overall, these results indicate that the exposure to climate risks affects the creditworthiness of loans and bonds issued by corporate. Financial regulators and policymakers should consider carefully the impact of climate change risks on the stability of both lending intermediaries and corporate bond markets.

Author: Gianfranco Gianfrate, EDHEC Business School

Journal of Cleaner Production, 2020/SSRN

Global carbon divestment and firms' actions

The authors examine the actions of financial institutions and firms regarding greenhouse gas emissions. They find that financial institutions around the world reduced their exposure to stocks of high-emission industries after 2015, especially for those located in high-climate-awareness countries, suggesting that institutions are concerned about climate risks in recent years. In the presence of divestment, firms in the same countries tend to experience lower price valuation ratios, which make equity financing costlier, but they increase capital expenditure and research and development (R&D) expenses and reduce emissions resulting from their operations. The results support the notion that divestment campaigns by financial institutions exert pressure on firms to adopt climate-friendly policies and decrease carbon footprints.

Authors: Darwin Choi, The Chinese University of Hong Kong (CUHK) - CUHK Business School; Zhenyu Gao, The Chinese University of Hong Kong (CUHK) - CUHK Business School; Wenxi Jiang, CUHK Business School, The Chinese University of Hong Kong

Via SSRN

How climate killed corals: the Great Barrier Reef in 2016

A squad of climate-related factors is responsible for the massive Australian coral bleaching event of 2016. If we're counting culprits: it's two by sea, one by land. First, El Niño brought warmer water to the Coral Sea in 2016, threatening Australia's Great Barrier Reef's corals. Long-term global warming meant even more heat in the region, according to a new CIRES assessment. And in a final blow that year, a terrestrial heat wave swept over the coast, blanketing the reef system well into the winter. The final toll: more than half the coral in some parts of the Great Barrier Reef died.

University of Colorado at Boulder via Science Daily

Words to live by . . . .

“I don’t like the term climate change to describe what’s coming. I much prefer ‘global weirding,’ because the weather getting weird is what is actually happening. The frequency, intensity and cost of extreme weather events all increase.” — Thomas L. Friedman, in The New York Times.